SMALL BUSINESS

HEALTH

INSURANCE

EXCHANGES

Low Initial Enrollment

Likely due to Multiple,

Evolving Factors

Report to the Chairman, Committee on

Small Business, House of

Representatives

November 2014

GAO-15-58

United States Government Accountability Office

United States Government Accountability Office

Highlights of GAO-15-58, a report to the

Chairman, Committee on Small Business,

House of Representatives

November 2014

SMALL BUSINESS HEALTH INSURANCE

EXCHANGES

Low Initial Enrollment Likely due to Multiple, Evolving

Factors

Why GAO Did This Study

The Patient Protection and Affordable

Care Act required SHOPs—

exchanges, or marketplaces, where

small employers can shop for health

coverage for their employees—to be

established in all states. States may

elect to establish and operate SHOPs

themselves or allow CMS to do so

within the state. Enrollment in SHOPs

was to begin in October 2013, with

coverage effective as early as January

2014. GAO was asked to examine the

early implementation experiences of

the SHOPs.

In this report GAO describes (1) SHOP

functionality, enrollment, plan

availability, and premiums and

(2) stakeholders’ views on key factors

that have affected current SHOP

enrollment or may affect future

enrollment growth. GAO reviewed

relevant information from CMS and

states, including data on employer and

employee enrollment, plan availability,

and premiums generally through

June 1, 2014. GAO also interviewed

representatives of key stakeholders

that operate SHOPs (CMS and states),

offer coverage in SHOPs (health

insurance issuers), obtain coverage

through SHOPs (small employers), or

assist in obtaining coverage through

SHOPs (agents and brokers) on a

national basis and, for certain

stakeholders, in five states—California,

Illinois, Kentucky, Rhode Island, and

Texas. The five states were selected

based on factors including varied

issuer participation levels and SHOP

functionality. The experiences of these

stakeholders cannot be generalized to

other states or stakeholders.

GAO incorporated HHS comments on

a draft of this report as appropriate.

What GAO Found

Though all of the Small Business Health Options Programs (SHOPs) required by

the Patient Protection and Affordable Care Act were operational, many features

were not yet available and enrollment was low as of June 2014. According to the

Centers for Medicare & Medicaid Services (CMS), the agency that oversees the

SHOPs, all 33 of the SHOPs run by CMS (federally facilitated, or FF-SHOPs)

and 14 of the 18 SHOPs run by states (state-based, or SB-SHOPs) were

accepting enrollment applications as of the October 1, 2013, deadline. The

remaining 4 SB-SHOPs became operational by the following May. Websites

where employers could review plan information such as premiums and benefits

were available on October 1, 2013, for all FF-SHOPs and most SB-SHOPs.

Other key SHOP features—online enrollment and employee choice, the ability for

employees to choose among multiple plans—were delayed for all FF-SHOPs, but

available for most of the SB-SHOPs. CMS is currently preparing to implement

online enrollment for all FF-SHOPs and employee choice for many of the FF-

SHOPs for 2015. Based on official estimates and stakeholders’ expectations,

enrollment for the SB-SHOPs has been significantly lower than expected. The 18

SB-SHOPs had enrolled about 76,000 individuals—including employees, their

spouses, and dependent children—in plans purchased through nearly 12,000

small employers, as of June 1, 2014, for most states. Enrollment data for the FF-

SHOPs was not yet available, although CMS was in the process of collecting the

data from issuers and expected to have complete data by early 2015. However,

CMS officials said they do not expect major differences in enrollment trends for

2014 between SB-SHOPs and FF-SHOPs. Finally, most SHOPs had multiple

plans available in each county, although a small number of states had counties

with no plans available. Premiums for SHOP plans varied across states and were

generally comparable to premiums for other small group plans offered within a

state but outside of the SHOP.

Stakeholders identified several factors that may have led to current low SHOP

enrollment and that may affect future enrollment growth. Many stakeholders

reported that the primary incentive for employers to use the SHOPs has been the

small business tax credit available to eligible employers who offer coverage

through a SHOP, although some noted that the credit may be too small and

administratively complex to motivate many employers to enroll. Other factors

identified that may have hindered current enrollment include the ability of

employers to renew plans that existed before the SHOPs—which, depending on

state requirements, is permitted until October 1, 2016—and employer

misconceptions about SHOP availability. Stakeholders also described factors

that may help stimulate or detract from future SHOP enrollment growth. For

example, the phase-out of existing pre-SHOP plans, the implementation of

employee choice by an increasing number of SHOPs, improved coordination with

agents and brokers, and increased marketing to small employers may help

stimulate enrollment growth. Conversely, other factors, such as the 2-year limit

on the availability of the small business tax credit and the likelihood, according to

stakeholders, that SHOP premiums will not be lower than non-SHOP premiums,

may hinder future enrollment growth. The evolving and localized nature of these

factors suggests that that a determination of the SHOPs’ long-term impact

remains premature at this time.

View GAO-15-58. For more information,

contact John Dicken at (202) 512-7114 or

dickenj@gao.gov.

Page i GAO-15-58 Small Business Health Insurance Exchanges

Letter 1

Background 4

SHOPs Were Operational in All States, Although Many Expected

Features Were Not Yet Available and Enrollment Was Low as

of June 2014 9

Stakeholders Identified Several Factors That May Have Led to

Current Low SHOP Enrollment and That May Affect Future

Enrollment Growth 18

Concluding Observations 29

Agency Comments 29

Appendix I Small Business Health Options Program (SHOP) Features as of

June 1, 2014 31

Appendix II State-Based Small Business Health Options Program (SB-SHOP)

Enrollment Generally as of June 1, 2014 33

Appendix III Small Business Health Options Program (SHOP) 2014 Average

Monthly Premiums for Silver-Tier Plans 34

Appendix IV Small Business Health Options Program (SHOP) Silver-Tier Plan

Availability 36

Appendix V Comments from the Department of Health and Human Services 38

Appendix VI GAO Contact and Staff Acknowledgments 40

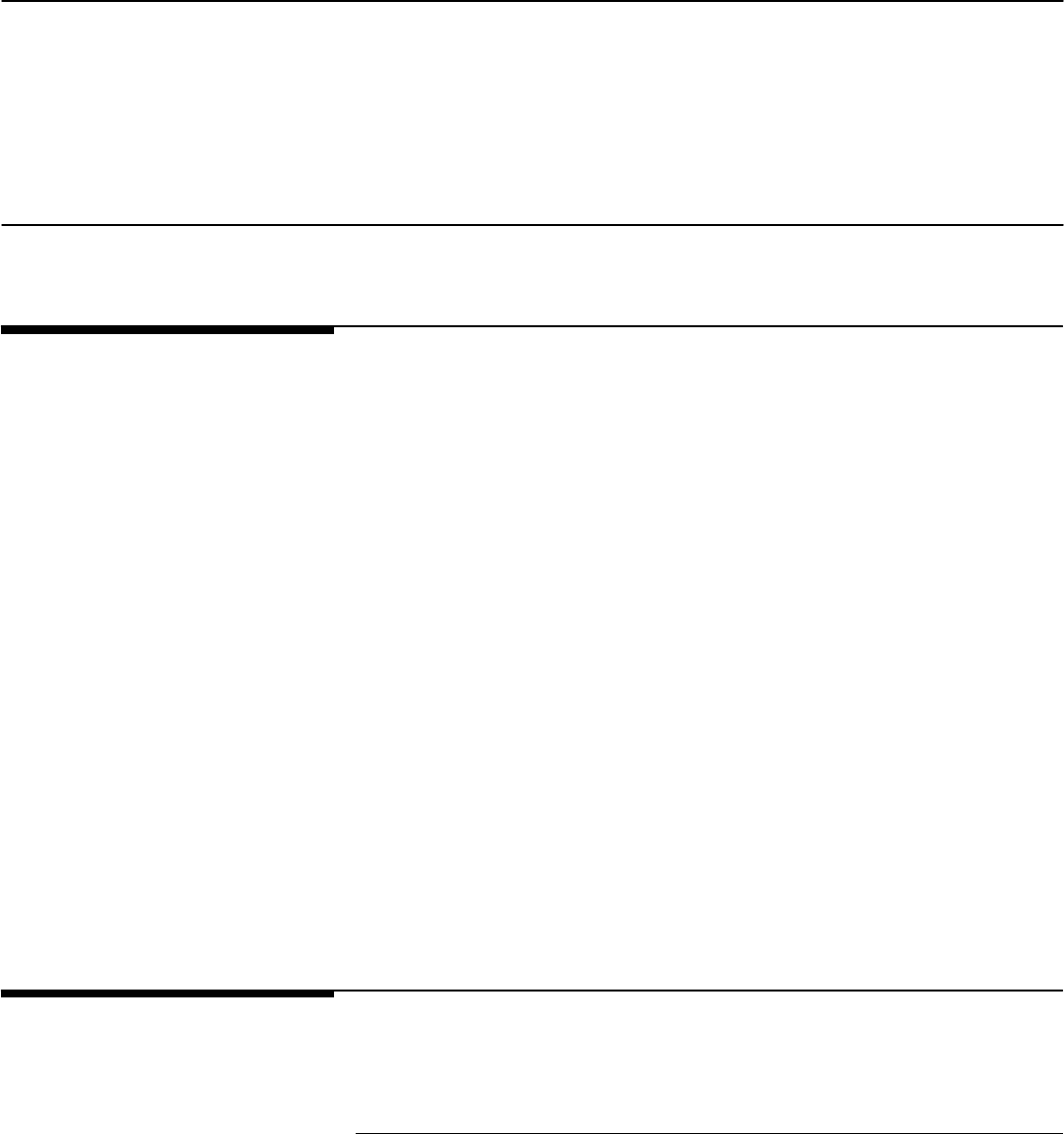

Figure

Figure 1: Total Enrollment in the State-Based Small Business

Health Options Programs (SB-SHOPs) Generally As of

June 1, 2014 13

Contents

Page ii GAO-15-58 Small Business Health Insurance Exchanges

Abbreviations

CBO Congressional Budget Office

CCIIO Center for Consumer Information and Insurance Oversight

CMS Centers for Medicare & Medicaid Services

FF-SHOP federally facilitated Small Business Health Options

Program

HHS Department of Health and Human Services

PPACA Patient Protection and Affordable Care Act

QHP qualified health plan

SB-SHOP state-based Small Business Health Options Program

SHOP Small Business Health Options Program

This is a work of the U.S. government and is not subject to copyright protection in the

United States. The published product may be reproduced and distributed in its entirety

without further permission from GAO. However, because this work may contain

copyrighted images or other material, permission from the copyright holder may be

necessary if you wish to reproduce this material separately.

Page 1 GAO-15-58 Small Business Health Insurance Exchanges

441 G St. N.W.

Washington, DC 20548

November 13, 2014

The Honorable Sam Graves

Chairman

Committee on Small Business

House of Representatives

Dear Mr. Chairman:

The Patient Protection and Affordable Care Act (PPACA) required the

creation in all states of Small Business Health Options Programs

(SHOPs)

1

—exchanges, or marketplaces, where small employers can

shop for and purchase health coverage for their employees.

2

SHOPs

were required to begin accepting enrollment applications for 2014

coverage by October 1, 2013, with coverage starting as early as

January 1, 2014.

3

A state may elect to establish and operate a SHOP

itself (through a state-based, or SB-SHOP) or allow the Department of

Health and Human Services’ (HHS) Centers for Medicare & Medicaid

Services (CMS) to establish and operate a federally facilitated SHOP

(FF-SHOP) within that state.

4

1

Pub. L. No. 111-148, §§ 1311(b), 1321(c),124 Stat. 119, 173, 186 (Mar. 23, 2010)

(codified at 42 U.S.C. §§ 18031(b), 18041(c)) (hereafter, “PPACA”), as amended by the

Health Care and Education Reconciliation Act of 2010, Pub. L. No. 111-152, 124 Stat.

1029 (Mar. 30, 2010) (hereafter, “HCERA”). In this report, references to PPACA include

any amendments made by HCERA.

In June 2013, we reported on the status of

federal and state efforts to establish the SHOPs. At that time, we found

that both CMS and states had made progress in establishing SHOPs,

In this report, the term “state” includes the District of Columbia.

2

PPACA also required the establishment of individual exchanges in each state where

eligible individuals can compare and select private insurance coverage from among

participating health insurance plans. The SHOPs and individual exchanges are intended

to provide single points of access to enroll employees of small businesses and individuals

into private health plans. Individual exchanges are also the access point to determine

eligibility for income-based premium subsidies and assess eligibility for other health

coverage programs such as Medicaid.

3

PPACA, § 1311(b)(1), 124 Stat. at 173 (codified at 42 U.S.C. § 13031(b)(1)); 45 C.F.R.

§ 155.410(b)-(c).

4

CMS has invited states to assist with certain FF-SHOP operations.

Page 2 GAO-15-58 Small Business Health Insurance Exchanges

although many activities remained to be completed and some were

behind schedule.

5

As the first year of SHOP operations nears its end, members of Congress

have raised questions about the challenges that SHOPs may face in

achieving long-term success. Such questions include whether SHOPs

have been able to provide online enrollment tools and other expected

functionalities, and in general whether SHOPs will offer sufficient value to

small employers to motivate them to enroll. You asked that we examine

the early implementation experiences of the SHOPs. In this report, we

describe

1. SHOP functionality, enrollment, plan availability, and premiums; and

2. stakeholders’ views on key factors that have affected current SHOP

enrollment or may affect future enrollment growth.

To describe early indicators of SHOP functionality, enrollment, plan

availability, and premiums, we requested information from CMS and

states and interviewed relevant officials. Specifically, to describe SHOP

functionality, including when SHOPs became operational, whether

SHOPs had a website that allowed employers to browse plan options and

enroll online, and whether SHOPs offered employers the ability to offer

their employees a choice among multiple plans, we requested information

from CMS and interviewed CMS officials. We analyzed CMS and SB-

SHOP data on plan availability and premiums in 2014, and we analyzed

SB-SHOP data on employer and employee enrollment for timeframes

ending between May and September 2014, with most ending on June 1,

2014. To assess the reliability of the data we received from CMS and

states, we performed manual and electronic tests of the data to identify

any outliers or anomalies and followed up with officials as necessary and

incorporated the corrections we received. We determined that the data

were sufficiently reliable for the purposes of our analysis. We also

reviewed other information sources, including published literature and

state SHOP websites, and identified federal requirements related to the

SHOPs by interviewing CMS officials and reviewing relevant laws and

regulations.

5

GAO, Patient Protection and Affordable Care Act: Status of Federal and State Efforts to

Establish Health Insurance Exchanges for Small Businesses, GAO-13-614 (Washington,

D.C.: June 19, 2013).

Page 3 GAO-15-58 Small Business Health Insurance Exchanges

To describe stakeholders’ views on key factors that have affected current

SHOP enrollment or may affect future enrollment growth, we interviewed

national-level representatives of key stakeholders that operate, offer

coverage in, obtain coverage through, or assist in obtaining coverage

through SHOPs. Specifically, we interviewed officials from CMS’s Center

for Consumer Information and Insurance Oversight (CCIIO) who oversee

the operation of SHOPs, as well as national organizations representing

issuers of health coverage, insurance commissioners, small employers,

and health insurance agents and brokers.

6

In addition, we selected five

states in which to interview state-level representatives of the SHOPs,

small employers, and agents and brokers.

7

To ensure that we captured a

range of SHOP-related experiences and perspectives, we selected states

that varied in terms of state population, geographic location, SHOP type

(FF-SHOP or SB-SHOP), SHOP website functionality, including the

availability of employee choice, and issuer participation in the SHOP. We

selected Kentucky, Rhode Island, California, Illinois, and Texas for our

study.

8

For the SB-SHOP states—Kentucky, Rhode Island, and

California—we interviewed state exchange officials. For the FF-SHOP

states—Texas and Illinois—we interviewed CMS officials involved with

the establishment and operation of the FF-SHOPs.

9

6

We interviewed representatives from the following national organizations: the Blue Cross

and Blue Shield Association, America’s Health Insurance Plans, the National Association

of Insurance Commissioners, the National Federation of Independent Business, and the

National Association of Health Underwriters.

Our work was limited

to reviewing illustrative examples of stakeholders’ experiences with and

perspectives on the SHOPs. The findings from our interviews therefore

cannot be generalized to the perspectives and experiences of all issuers,

insurance commissioners, employers, agents and brokers, or state

exchange officials.

7

The employer and agent and broker organizations for which we interviewed state-level

representatives were, respectively, the National Federation of Independent Business and

the National Association of Health Underwriters. We refer to state-level officials who have

participated in the establishment and operation of SHOPs as state exchange officials.

8

We interviewed agent and broker representatives in Kentucky, California, Illinois, and

Texas, and employer representatives in California, Rhode Island, and Illinois. The agent

and broker representative we contacted in Rhode Island and the employer representatives

we contacted in Kentucky and Texas elected not to participate in an interview.

9

We also interviewed state exchange officials in Illinois, who are assisting CMS in

operating the FF-SHOP in that state.

Page 4 GAO-15-58 Small Business Health Insurance Exchanges

We conducted this performance audit from February 2014 to November

2014 in accordance with generally accepted government auditing

standards. Those standards require that we plan and perform the audit to

obtain sufficient, appropriate evidence to provide a reasonable basis for

our findings and conclusions based on our audit objectives. We believe

that the evidence obtained provides a reasonable basis for our findings

and conclusions based on our audit objectives.

PPACA included a number of provisions that changed requirements for

small group health plans.

10

For example, PPACA required that, beginning

January 1, 2014, plans offer a set of minimum essential health benefits.

PPACA also set standards for the percentage of total average costs that

plans must cover for such benefits. The average costs covered by each

plan are reflected in different plan levels, or tiers, and each tier is

designated as bronze, silver, gold, or platinum.

11

In addition, beginning on

January 1, 2014, issuers are no longer able to consider the average

health status of a particular group when setting premium rates and can

only adjust premiums based on enrollment type (individual or family

enrollment), geographic area, age, and tobacco use.

12

PPACA required all small group health plans to comply with these

requirements as of January 1, 2014.

Plans meeting

these and other federal requirements, as well as other standards set by

states, may be certified to be offered in an exchange; these plans are

referred to as qualified health plans (QHPs).

13

10

These requirements apply to small group health plans whether they are sold inside or

outside of the SHOPs.

However, in response to concerns

regarding some issuers terminating plans that did not comply with PPACA

11

For a bronze-tier plan, on average, an employee would be responsible for 40 percent of

the costs of all covered benefits; for a silver-tier plan, on average, an employee would be

responsible for 30 percent; for a gold-tier plan, on average, an employee would be

responsible for 20 percent; and for a platinum-tier plan, on average, an employee would

be responsible for 10 percent of the costs of all covered benefits. PPACA requires that

issuers participating in an exchange offer, at a minimum, plans at both the silver and gold

levels of coverage.

12

There are further restrictions in the amount issuers can vary premiums based on the

ages and tobacco use of employees within a small group.

13

PPACA provided a narrow exception from these requirements for “grandfathered

plans”—health plans in which an individual was enrolled on March 23, 2010.

Background

Page 5 GAO-15-58 Small Business Health Insurance Exchanges

requirements, CMS announced in November 2013 that it would provide

transitional relief under which states could elect to permit issuers in their

states to offer renewals of their noncompliant plans for a plan year

beginning between January 1, 2014, and October 1, 2014, provided the

plans met certain conditions.

14

In March 2014, CMS extended this

transitional policy through October 1, 2016, and noted that the agency

may grant an additional 1 year extension, if necessary.

15

PPACA also mandated the establishment of SHOPs in each state to allow

small employers to compare available health insurance options in their

states and facilitate the enrollment of their employees in coverage. Until

2016, states have the option to define small employers either as

employers with 100 or fewer employees or employers with 50 or fewer

employees.

16

The SHOPs are required to have certain functionalities to facilitate the

health plan comparison and enrollment process. For example, each

SHOP must provide access to the SHOP to employers and employees

through a website, toll-free call centers, and in person. Each SHOP must

present the QHPs approved by the SHOP for the small-employer market

To be eligible for SHOP coverage, a small employer must

offer coverage to all full-time employees in a QHP through a SHOP. To

be eligible to enroll in a QHP through a SHOP, an individual must have

been offered health insurance coverage by a qualified employer through a

SHOP.

14

Conditions included that the coverage was in effect on October 1, 2013 and that

appropriate notices were provided to individuals and small employers. See Department of

Health and Human Services, Centers for Medicare & Medicaid Services, Centers for

Consumer Information & Insurance Oversight, Letter to Insurance Commissioners on

Market Transitional Policy, November 14, 2013, accessed September 8, 2014,

http://www.cms.gov/CCIIO/Resources/Letters/Downloads/commissioner-letter-11-14-

2013.PDF. According to CMS, 39 states adopted the transitional policy for 2014, while

12 states did not.

15

See Department of Health and Human Services, Centers for Medicare & Medicaid

Services, Extension of Transitional Policy through October 1, 2016, (Washington, D.C.:

Mar. 5, 2014). Under this policy, depending on state requirements, some small employers

may choose to remain enrolled in noncompliant plans through the end of plan years

beginning on or before October 1, 2016.

16

Under PPACA, beginning in 2016, small employers will be defined in all states as those

with 100 or fewer full-time equivalent employees. Beginning in 2017, states may allow

issuers of health insurance coverage in the large group market—issuers offering coverage

to groups of 101 or more full-time equivalent employees—to offer QHPs through the

SHOP and, in turn, will allow large employers to obtain coverage through the SHOP.

Page 6 GAO-15-58 Small Business Health Insurance Exchanges

in the state by the participating issuers of health coverage.

17

In addition,

the benefits, cost-sharing features, and premiums of each QHP must be

presented in a manner that facilitates comparison shopping of plans by

small employers and their employees. Each SHOP must accept employer

and employee applications through the SHOP website and may also

accept applications over the phone, in person, or by mail. This application

should collect the information necessary to screen an employer’s

eligibility for SHOP participation and identify employees eligible to enroll

in a QHP. Employers and employees may receive assistance to compare

coverage options and complete applications through a qualified insurance

agent or broker.

18

In addition, SHOPs will implement requirements related to employee

choice—that is, the ability of employees to choose a plan among multiple

plans offered to them by their employer.

19

17

All issuers or members of the same issuer group with a market share of greater than

20 percent in the state’s small group health insurance market must participate in a state’s

FF-SHOP if they wish to participate in its federally facilitated individual exchange. For

other issuers, participation is generally voluntary. States with SB-SHOPs may also impose

requirements related to issuer participation—for example, Maryland required issuers to

participate in its SB-SHOP if the issuers’ reported total annual earned premiums were

$20 million or more in the small group market outside the exchange.

Employee choice may be

offered in different ways. In general, a SHOP must allow a qualified

employer to offer its employees a choice among all QHPs available within

a specific metal tier of coverage, but may allow an employer to offer

18

Small employers and employees may also receive assistance from Navigators, who are

individuals and entities, such as community and consumer-focused nonprofit groups,

which receive grants from exchanges and provide information and services in a fair and

impartial manner to enrollees or potential enrollees. However, CMS has noted that

Navigators have focused largely on the individual exchanges, and that brokers have

played a much more central role in the SHOPs—as they have traditionally done in the

small-group health coverage market—providing service at the time of plan selection and

enrollment and customer service throughout the plan year.

19

In general, when offering coverage though a SHOP, employers select a plan, which

becomes the employer's reference plan. Employers also decide the percentage they will

contribute to the premiums for employees who select that plan, referred to as a defined

contribution. Employees who have been offered a choice of plans are typically able to use

the amount of the defined contribution for the reference plan when paying their premiums

for a different SHOP plan.

Page 7 GAO-15-58 Small Business Health Insurance Exchanges

broader employee choices among multiple plans across different tiers.

20

According to CMS, employee choice is intended to be a fundamental new

benefit of SHOPs, in that small employers would be able to offer multiple

plans from more than one issuer of health coverage, whereas traditionally

most small employers have offered only one or a few plans from a single

issuer. SHOPs were initially required to have the capacity to allow

employers to provide employee choice beginning in 2014. However,

under a final rule issued in June 2013, the requirement that SHOPs offer

employee choice was first postponed to 2015, although SB-SHOPs

retained the option of providing employee choice in 2014. The

requirement was further postponed under a May 2014 final rule to 2016 in

states that could demonstrate that postponing employee choice would be

in the best interest of small employers and their employees and

dependents, given the likelihood that implementing employee choice

could cause issuers to price their products and plans higher than they

would otherwise due to issuers’ beliefs about adverse selection.

21

To provide an incentive for small employers to provide health insurance,

and to make insurance more affordable, PPACA established a small

business tax credit for certain eligible small employers offering coverage

to their employees.

22

20

To make it more administratively efficient for employers to provide their employees a

choice of QHP, CMS also required SHOPs to perform premium aggregation—that is, to

aggregate the QHP premiums for multiple employees enrolling in SHOP coverage,

provide the relevant employer with a single bill identifying the total amount that is due to

the one or more QHPs in which the employer’s employees are enrolled, collect the

appropriate amount from each employer, and pay the issuers of the QHPs directly.

The tax credit was available beginning in 2010, prior

to the establishment of SHOPs. However, beginning in 2014, employers

must offer coverage to their employees through the SHOP to be eligible

21

See 79 Fed. Reg. 30240, 30349-50 (May 27, 2014) (to be codified at 45 C.F.R.

§ 155.705(b)(2)-(3)). Adverse selection refers to the potential for consumers with fewer

health concerns to select certain plans—particularly those with lower premiums—and for

consumers with greater health concerns to select other, more comprehensive plans.

Applications for consideration of delaying employee choice until 2016 were due to CMS by

June 2, 2014 for FF-SHOPs. According to CMS, the agency remains committed to

implementing employee choice in all SHOPs by 2016.

22

PPACA, §§ 1421, 10105(e), 124 Stat. at 237, 906 (codified at 26 U.S.C. § 45R).

To be eligible, an employer must: (1) have fewer than the equivalent of 25 full-time

employees, (2) have an average annual employee wage below $50,000, and (3) cover at

least 50 percent of the cost of health insurance coverage for employees.

Page 8 GAO-15-58 Small Business Health Insurance Exchanges

for the credit.

23

Beginning in 2014, employers are eligible for the credit for

a maximum of 2 years.

24

PPACA directed states to establish SHOPs by January 1, 2014.

25

In

states electing not to establish and operate an SB-SHOP, PPACA

required the federal government to establish and operate an FF-SHOP in

the state.

26

For 2014, 18 states chose to operate SB-SHOPs while 33

states opted for an FF-SHOP.

27

23

The Internal Revenue Service has stated that in 2014, small employers in certain

counties in Wisconsin and Washington where SHOP plans are not offered may be eligible

for the tax credit if they offer coverage that would have qualified for the credit prior to

January 1, 2014. See Internal Revenue Service, Section 45R – Transition Relief with

Respect to the Tax Credit for Employee Health Insurance Expenses of Certain Small

Employers, Internal Revenue Bulletin: 2014-2 (Washington, D.C.: January 6, 2014).

CMS’s and states’ roles in operating

24

The tax credit offered to eligible small employers from 2010 through 2013 was smaller

than the credit offered beginning in 2014, but had no restrictions on the number of years

employers could receive the credit. From 2010 through 2013, for-profit employers were

eligible for a credit of up to 35 percent of the employers’ share of the employees’

premiums, and nonprofit employers were eligible for a credit of up to 25 percent.

Beginning in 2014, eligible for-profit employers may receive a credit of up to 50 percent of

the employers’ share of the employees’ premiums, and nonprofit employers meeting the

eligibility criteria may receive a credit of up to 35 percent. The maximum credit is available

to employers with 10 or fewer employees and with an average annual employee wage of

$25,000 or less, and the size of the credit employers are eligible for decreases as

employer size and average employee wage increase.

25

PPACA, § 1311(b)(1), 124 Stat. at 173 (codified at 42 U.S.C. § 18031(b)(1)).

26

PPACA, § 1321(c), 124 Stat. at 186 (codified at 42 U.S.C. § 18041(c)).

27

The 18 states that had SB-SHOPs in 2014 were California, Colorado, Connecticut,

Hawaii, Kentucky, Maryland, Massachusetts, Minnesota, Mississippi, Nevada, New

Mexico, New York, Oregon, Rhode Island, Utah, Vermont, Washington, and the District of

Columbia.

CMS officials noted that Idaho, although initially approved as an SB-SHOP state, used the

FF-SHOP platform in 2014. We therefore refer to Idaho as having an FF-SHOP in 2014

for the purposes of our report. Including Idaho, the 33 states that had FF-SHOPs in 2014

were Alabama, Alaska, Arizona, Arkansas, Delaware, Florida, Georgia, Idaho, Illinois,

Indiana, Iowa, Kansas, Louisiana, Maine, Michigan, Missouri, Montana, Nebraska, New

Hampshire, New Jersey, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania,

South Carolina, South Dakota, Tennessee, Texas, Virginia, West Virginia, Wisconsin, and

Wyoming. Some states were approved by CMS to assist with certain FF-SHOP functions

associated with consumer assistance and plan management.

These states differ from the SB-SHOP and FF-SHOP states presented in our June 2013

report (GAO-13-614) because Idaho had an FF-SHOP according to our definition, while

Mississippi operated an SB-SHOP, in 2014.

Page 9 GAO-15-58 Small Business Health Insurance Exchanges

SHOPs and individual exchanges may change in future years. CMS

officials stated that as of September 2014, Nevada was planning to begin

using the FF-SHOP platform, while Idaho was planning to begin using its

own state-based platform, in 2015.

Though SHOPs were operational in all states as of June 1, 2014, many

expected features were not yet available for a number of SHOPs.

Enrollment for the SB-SHOPs, as of June 1, 2014 for most states, has

been lower than expected, and CMS officials said they do not expect the

enrollment trends for the FF-SHOPs to be significantly different, although

they are still in the process of collecting enrollment data. Most SHOPs

had multiple plans available in each county, though in some states there

were a few counties with no plans available. Premiums varied across

states, though were generally comparable to premiums for small group

plans within the same state offered outside of the SHOPs.

All of the FF-SHOPs and most of the SB-SHOPs were operational as

required—that is, accepting enrollment applications—as of October 1,

2013. According to CMS, four of the SB-SHOPs—Hawaii, Maryland,

Mississippi, and Oregon—were not operational as of the October 1, 2013,

deadline, although all have since become operational. Hawaii became

operational on October 15, 2013, Maryland became operational on

April 1, 2014, and Oregon and Mississippi became operational on

May 1, 2014.

Websites where employers could review plan information, including

premiums and benefits, were available on October 1, 2013, for all FF-

SHOPs and most SB-SHOPs. This information allows employers and

employees to make meaningful comparisons about available SHOP plans

in their state. Plan information for the FF-SHOPs was provided by CMS

through its website. According to CMS, on October 1, 2013, the SB-

SHOPs in Maryland, Oregon, and Mississippi lacked websites where

employers could review plan and premium information. Mississippi has

since added plan and premium information to its websites. Oregon and

Maryland have directed employers to contact agents and brokers or

issuers to review plan options.

SHOPs Were

Operational in All

States, Although

Many Expected

Features Were Not

Yet Available and

Enrollment Was Low

as of June 2014

SHOPs Were Operational

in All States, Although

Many Expected Features

Were Not Yet Available,

Particularly for the

Federally Facilitated

SHOPs

Page 10 GAO-15-58 Small Business Health Insurance Exchanges

According to CMS, most SB-SHOPs created online enrollment portals by

October 1, 2013, though a handful of states—Maryland, Oregon,

California, and Mississippi—did not have online enrollment portals

available or had to take them offline, requiring employers to enroll directly

through issuers. For example, the California SHOP initially offered online

enrollment but took its enrollment portal down in February 2014 due to

technical challenges, leaving small businesses in California able to enroll

in SHOP plans only through direct enrollment. Online enrollment for the

Mississippi SHOP began when it became operational in May 2014, while

Maryland and Oregon have yet to implement online enrollment for their

SHOPs.

CMS did not implement online enrollment in the FF-SHOPs in 2014. As a

result, employers enrolling in any of the FF-SHOPs, starting in October

2013, had to enroll in SHOP coverage either through agents and brokers

or directly through issuers.

28

CMS is currently preparing to implement

online enrollment for the FF-SHOPs for 2015, and expects to launch

online enrollment fully in all FF-SHOPs by November 15, 2014, when

SHOP enrollment begins for 2015.

29

The online enrollment system will

allow, among other functions, enhanced features for agents and brokers,

notification to employees of their employers’ annual open enrollment

period, online employer payments, transmitting of enrollment and

payment transactions to issuers, and the processing of coverage

changes.

30

According to CMS, fifteen SB-SHOPs offered employee choice in 2014

through a variety of approaches, though employee choice was delayed

for the FF-SHOPs until 2015. These approaches included enabling

28

CMS and other stakeholders we interviewed noted that small employers have

traditionally used direct enrollment methods, such as working with agents and brokers, to

apply for small group coverage.

29

In preparation for launching online enrollment, CMS planned to partially launch online

enrollment early in five FF-SHOP states (Delaware, Illinois, Missouri, New Jersey, and

Ohio) in October 2014. Employers were to be able to log in, create an account, and

complete the eligibility application, or authorize an agent or broker to assist with signing up

for SHOP coverage.

30

CMS plans to add functionality to support its online system in early 2015, including

enhanced call center access to assist employers, employees, and agent and brokers;

integration with the other exchange systems to facilitate IRS reporting and data analytics;

and the handling of coverage terminations and delinquent payments.

Page 11 GAO-15-58 Small Business Health Insurance Exchanges

employers to offer a choice of plans across all metal tiers and all issuers;

a choice of plans across one metal tier but for multiple issuers; or a

choice of plans from one issuer but across multiple metal tiers. Some

states allowed the employer to choose which employee choice model to

use, while other states only offered one approach. Four states, including

California, required that employers offer their employees a choice of

plans, while others, including Rhode Island and Kentucky, gave

employers the option of choosing one plan or offering wider plan choice to

their employees.

The majority of enrolled employers in SB-SHOP states where data was

available took advantage of the employee choice feature. For example,

exchange officials in Kentucky and Rhode Island said that approximately

65 and 61 percent of enrolled employers, respectively, decided to offer

their employees a choice of plans.

31

CMS did not offer employee choice in the FF-SHOPs in 2014 but plans to

do so for many FF-SHOPs for 2015. However, CMS offered state

insurance commissioners the chance to recommend whether or not

employee choice should be implemented in their state for 2015 or

delayed until 2016, if the commissioners could adequately explain that

this would be in the best interest of small employers and their employees

In Rhode Island, in cases where

employers offered the choice of any plans through the SHOP, just over

50 percent of their employees chose the reference plan the employer had

selected, 14 percent selected a different plan within the same tier,

13 percent purchased a lower metal tier—or less expensive—plan than

the reference plan, and 21 percent purchased a higher metal tier—or

more expensive—plan than the reference plan. CMS officials said that

two additional SB-SHOPs, Colorado and New York, reported that a

majority of employers decided to offer their employees a choice of plans.

However, three SB-SHOPs did not offer employee choice in 2014:

Maryland, Massachusetts, and Oregon. Massachusetts was unable to

offer employee choice because its online system for employee choice is

still in development, according to CMS officials. Maryland and Oregon

were unable to offer employee choice because SHOP enrollment was

only available through direct enrollment, according to CMS and state

officials, respectively.

31

The remaining employers offered their employees one SHOP plan. All employers

offering coverage through California’s SHOP offered employee choice, as this was a

requirement for participating in the state’s SHOP.

Page 12 GAO-15-58 Small Business Health Insurance Exchanges

and dependents.

32

Fourteen FF-SHOP states chose to allow CMS to

implement employee choice for 2015 while 18 FF-SHOP states chose to

delay employee choice until 2016.

33

(See app. I for additional details on

SHOP functionality as of June 1, 2014.)

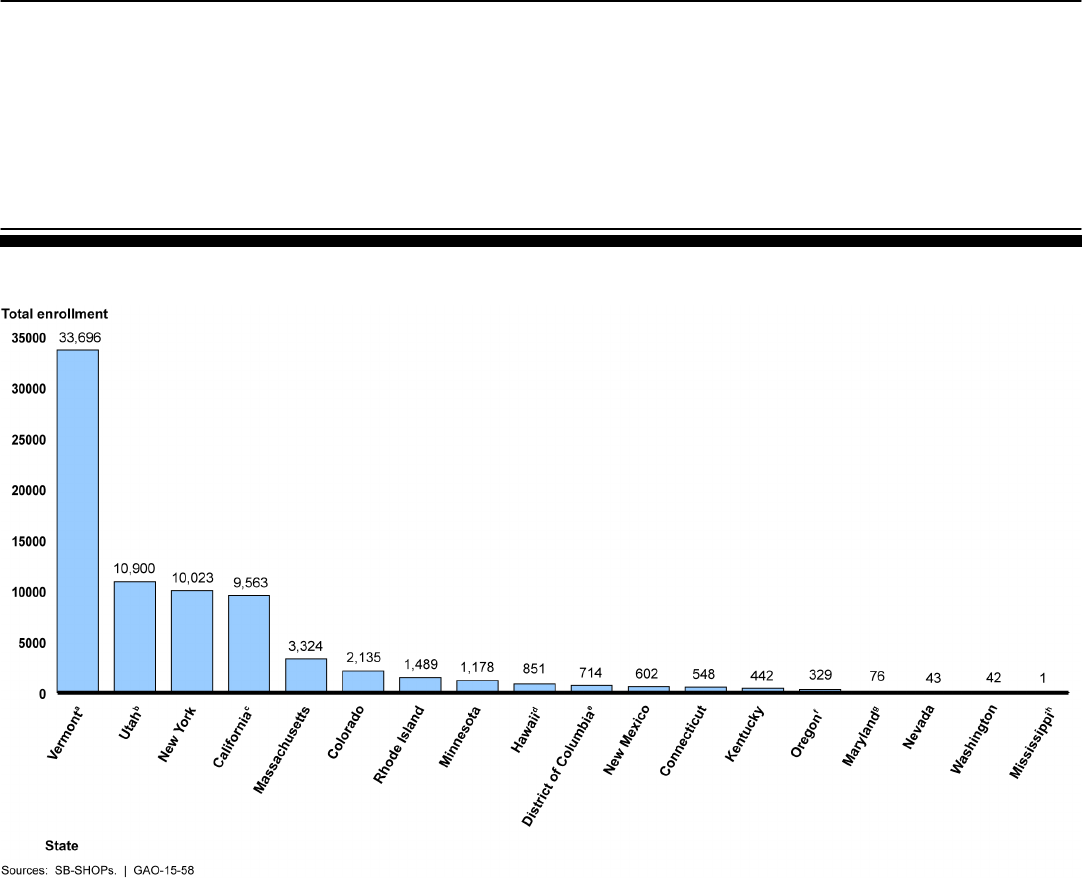

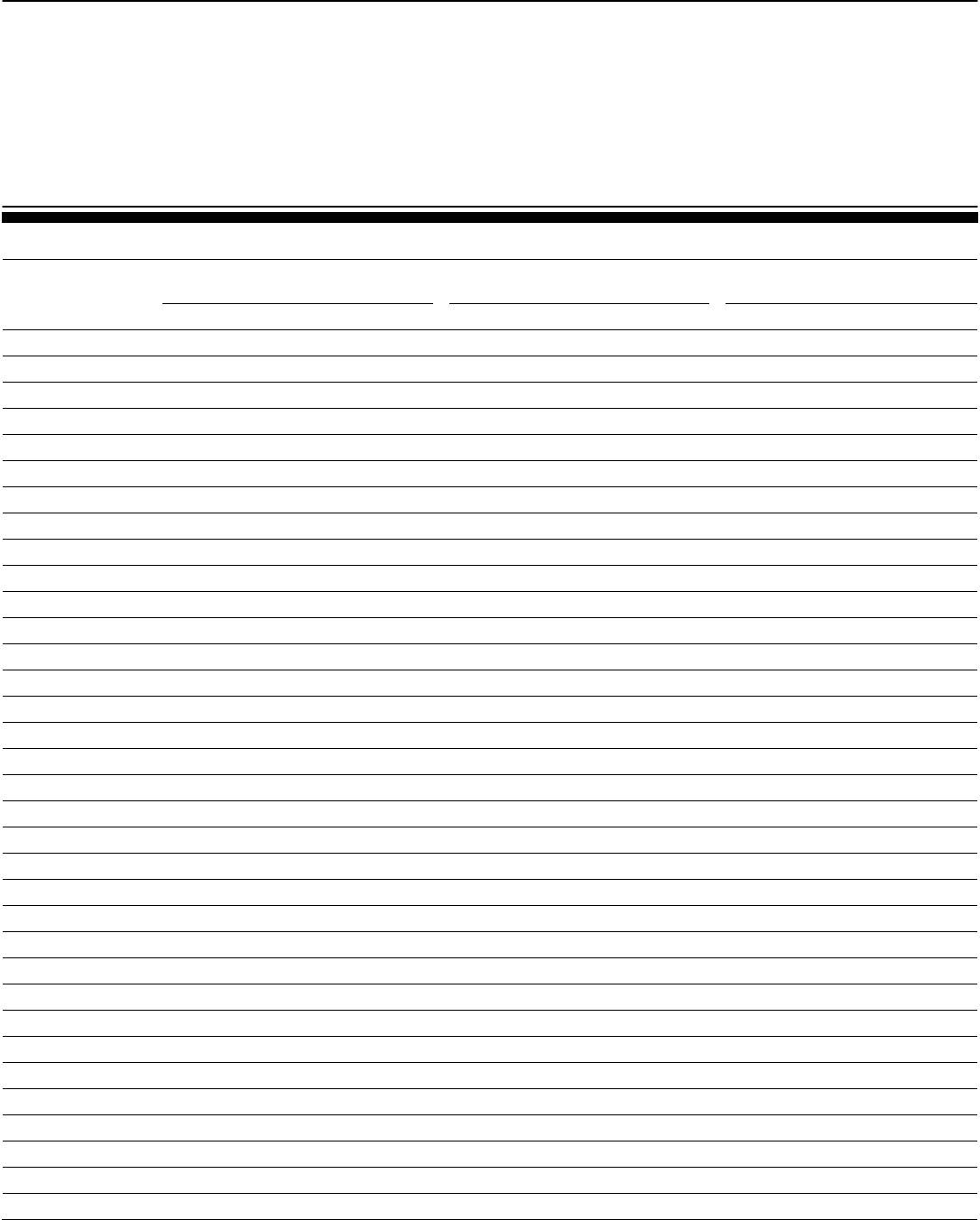

SB-SHOP plans had enrolled approximately 76,000 individuals—including

employees, spouses, and dependent children—into plans purchased

through 11,742 small employers, as of June 1, 2014 for most states, with

end dates ranging from May to September 2014. Enrollment varied widely

among the 18 states with SB-SHOPS, from 33,696 individuals (purchased

through 3,580 small employers) in Vermont,

34

to 1 individual (purchased

through 1 small employer) in Mississippi.

35

(See fig. 1.)

32

79 Fed. Reg. 30240, 30349-50 (May 27, 2014) (to be codified at 45 C.F.R.

§ 155.705(b)(2)-(3)).

33

CMS required that FF-SHOP states notify the agency of their preference and justification

for delaying employee choice until 2016. CMS approved the delay of employee choice

until 2016 for 18 FF-SHOPs: Alabama, Alaska, Arizona, Delaware, Illinois, Kansas,

Louisiana, Maine, Michigan, Montana, New Hampshire, New Jersey, North Carolina,

Oklahoma, Pennsylvania, South Carolina, South Dakota, and West Virginia. In addition,

Nevada, an SB-SHOP in 2014, will use the FF-SHOP platform in 2015 and will not offer

employee choice. The 14 FF-SHOP states that chose to allow CMS to implement

employee choice for 2015 were Arkansas, Florida, Georgia, Indiana, Iowa, Missouri,

Nebraska, North Dakota, Ohio, Tennessee, Texas, Virginia, Wisconsin, and Wyoming.

34

Vermont required that all small group plans in the state be offered only through the

SHOP.

35

Mississippi provided enrollment information as of July 1, 2014. Mississippi’s SHOP did

not come online until May, which limited the time that small employers have had to enroll.

State-Based SHOP

Enrollment Was

Significantly Lower than

Anticipated, While

Enrollment Data for

Federally Facilitated

SHOPs Were Not Yet

Available

Page 13 GAO-15-58 Small Business Health Insurance Exchanges

Figure 1: Total Enrollment in the State-Based Small Business Health Options Programs (SB-SHOPs) Generally As of June 1,

2014

Notes: Figure indicates the total number of individuals (including the employees, spouses, and any

dependent children) covered by SB-SHOP plans.

a

Vermont required that all small group plans in the state be offered only through the SHOP. Vermont

provided data as of June 13, 2014.

b

Utah had an operational exchange for small employers prior to the enactment of the Patient

Protection and Affordable Care Act.

c

California provided data as of May 22, 2014.

d

The number for Hawaii only reflects the number of employees covered, as total enrollment was not

available.

e

The number for the District of Columbia does not include Congressional employees who are required

to obtain coverage through the District of Columbia’s SB-SHOP in order to receive a government

contribution toward their health insurance premiums under the Federal Employees Health Benefits

Program.

f

The number for Oregon only reflects the number of employees covered, as total enrollment was not

available.

g

Maryland provided data as of September 15, 2014.

h

Mississippi provided data as of July 1, 2014.

Page 14 GAO-15-58 Small Business Health Insurance Exchanges

Based on the average number of employees who enrolled in each state

per small employer, it appears that the employer groups that enrolled in

the SHOPs generally had few employees, particularly given that states

allowed employers with as many as 50 employees to enroll in the SHOPs

in 2014. Overall, the average number of employees per employer was

3.7, although the average number of employees enrolled per employer in

each state varied. Employers that enrolled in Utah had the largest

average number of employees enrolled per employer, 8.3, while New

York had the smallest average number of employees enrolled per

employer, 1.6.

36

Based on official estimates and stakeholders’ expectations, SB-SHOP

enrollment—as of June 1, 2014 for most states, with end dates ranging

from May to September 2014—was significantly lower than anticipated

and, at its current pace, is unlikely to reach expectations by the end of

2014.

(See app. II for additional details on SB-SHOP

enrollment.)

37

In April 2014, the Congressional Budget Office (CBO) estimated

that 2 million employees would enroll in coverage through the SB-SHOPs

and FF-SHOPs in 2014, with the number of enrollees rising to 3 million in

2015 and leveling off at 4 million enrollees by 2017.

38

36

Mississippi is a unique situation in that only one employer enrolled and so was not

included in this calculation.

In general,

stakeholders we spoke with said that SHOP enrollment has been low,

often lower than anticipated. For example, officials from the three SB-

SHOPs we spoke to all said that enrollment has been low, with officials

from two of the states indicating enrollment was lower than expected.

Officials from the third state said challenges related to implementation

and the lack of resources for marketing the SHOP had already lowered

their expectations for enrollment, though they acknowledged that

enrollment was generally low. Further, other stakeholders, including

issuer, employer, and agent and broker representatives, also said that

enrollment to date has been lower than anticipated.

37

CMS officials cautioned against inferring future enrollment trends from the partial-year

enrollment data for 2014. Officials said that employers may enroll in the SHOPs at any

point in the year, unlike individuals pursuing coverage in the individual exchanges, which

have limited open enrollment periods. According to the officials, more employers will likely

become eligible for SHOP coverage in later months, when their existing non-SHOP plans

end.

38

See Congressional Budget Office, Updated Estimates of the Effects of the Insurance

Coverage Provisions of the Affordable Care Act (Washington, D.C.: April 2014).

Page 15 GAO-15-58 Small Business Health Insurance Exchanges

Enrollment data for the FF-SHOPs was not yet available, though CMS

officials reported that the agency was in the process of collecting the data

from issuers. According to officials, because CMS was not ultimately

prepared to implement online enrollment it has had to require each issuer

involved in an FF-SHOP to manually report enrollment data. This data

reporting role for issuers had not originally been anticipated, and so CMS

has had to work with issuers to develop protocols to submit the data.

CMS officials said that they are working on a system through which

issuers can report their 2014 SHOP enrollment data, and that they expect

to have initial data by fall of 2014 but will not have complete data for 2014

until early 2015.

39

However, CMS officials said they do not have reason to

expect major differences in enrollment trends for 2014 between the SB-

SHOPs and the FF-SHOPs. Beginning in 2015, CMS officials said they

plan to have online enrollment that will likely facilitate the more timely and

accurate collection of enrollment data.

40

39

CMS officials noted that some issuers have reported to CMS that they are unable to

accurately report complete enrollment data for 2014, which could underestimate actual

enrollment numbers ultimately reported to CMS later in 2014.

40

While enrollment data is not available for FF-SHOPs, employers that are interested in

applying for the small business tax credit in 2014 must submit paper applications to CMS

to obtain an official SHOP eligibility determination. CMS reported that it had received

12,376 paper applications from employers for FF-SHOPs as of September 8, 2014.

According to CMS officials, employers that are interested in the tax credit have up to one

year after enrolling in the SHOP to submit their paperwork to CMS. As a result, the

number of paper applications for the SHOP tax credit as of September 8, 2014 likely

differs from the actual number of employers that plan to apply for the tax credit in 2014. In

addition, as some enrollees in the SHOP may not be eligible for or interested in applying

for the tax credit, the number of paper applications likely differs from actual employer

enrollment in the FF-SHOPs.

Page 16 GAO-15-58 Small Business Health Insurance Exchanges

In nearly all states, multiple issuers offered multiple plans in the SHOPs in

2014. The total number of participating issuers and plans in each state

varied widely from 1 to 13 issuers and 3 to 320 plans.

41

Forty-five states

had more than one issuer participating in their SHOP and 31 states had 3

or more participating issuers and each issuer offered, on average, 12

plans in each rating area.

42

In looking at silver-tier plans specifically, we found that most states had at

least one silver-tier plan available in each county, though New York,

Washington, and Wisconsin had counties where no silver-tier plans were

available.

43

The type of plan with the highest enrollment also varied across SB-SHOP

states, as did the proportion of employees enrolling in these plans.

Further, most states had at least two silver-tier plans available

in each county. When looking at the total number of silver-tier plans,

Washington, D.C., offered the most, with 89, while Arkansas, New

Hampshire, and West Virginia each only had one silver-tier plan available.

Regarding issuer participation in the SHOPs, we found that just over half

of states offered silver-tier plans from two or more issuers in each county.

Maryland had the most issuers offering silver-tier plans in its SHOP, with

13, though six states—Arkansas, Mississippi, New Hampshire, North

Carolina, Washington, and West Virginia—had only one issuer offering

silver-tier plans.

44

41

For additional details on issuer participation in both the individual and small business

exchanges beginning in 2014, as well as how this compares with issuer participation in the

individual and small group markets prior to the exchanges, see GAO, Patient Protection

and Affordable Care Act: Largest Issuers of Health Coverage Participated in Most

Exchanges, and Number of Plans Available Varied,

The

highest enrollment plans in each state were most often gold-tier. The plan

with the highest enrollment was a gold-tier plan in seven states, a silver-

GAO-14-657 (Washington D.C.:

August 29, 2014)

42

PPACA required each state to establish geographical rating areas that all issuers in the

state must use as part of their rate setting. In some states these rating areas are based on

counties, while in others they are based on Metropolitan Statistical Areas.

43

As noted previously, PPACA requires that issuers participating in the SHOP offer, at a

minimum, plans at both the silver and gold levels of coverage.CMS officials said that they

expect SHOP plans to be offered in these counties in plan year 2015.

44

Enrollment data for the FF-SHOPs was not yet available, though CMS officials reported

that the agency was in the process of collecting the data from issuers.

Most SHOPs Have

Multiple Plans Available in

Each County, and Plan

Premiums Varied Across

States and Were

Generally Comparable to

Similar Plans Outside the

SHOPs

Page 17 GAO-15-58 Small Business Health Insurance Exchanges

tier plan in five states, and a platinum-tier plan in five states.

45

The

proportion of individuals enrolled in the highest enrollment plan ranged

from approximately one-fourth of enrollees in California, Connecticut,

Kentucky, and Vermont to less than 10 percent in Minnesota, New

Mexico, New York, and Utah.

46

Premiums for silver-tier plans varied within and across states,

(See app. II for additional details on the

highest enrollment SB-SHOP plans.)

47

though no

clear patterns emerged. Monthly silver-tier plan premiums for enrollees

aged 21 ranged widely from $138 for the least expensive Hawaii plan to

$523 for the most expensive Alaska plan, with the median plan costing

$262.

48

For enrollees aged 40, the monthly premiums varied from $176

for the least expensive Hawaii plan to $669 for the most expensive Alaska

plan, with the median plan costing $335. Finally, for enrollees aged 60,

the monthly premiums varied from $375 for the least expensive Hawaii

plan to $1421 for the most expensive Alaska plan, with the median plan

costing $711. The differences between the premiums of the most

expensive and least expensive silver-tier plans within a given state also

varied widely. Arizona had the largest difference, with the most expensive

plan costing almost three times as much as the lowest-cost plan.

49

North

Carolina had the least disparate silver-tier plan premiums, with the most

expensive plan costing only approximately five percent more than the

least expensive plan.

50

45

Mississippi was excluded from this summary because it only had one enrollee as of

July 1, 2014.

(See app. III for additional details about SHOP

premium variation across states.)

46

Mississippi was excluded from this analysis because it only had one enrollee as of

July 1, 2014. Hawaii and Oregon were excluded because they were unable to provide

total enrollment, and Washington was excluded because it was unable to provide total

enrollment for the highest enrollment plan.

47

We focused our analysis of plan premiums on silver-tier plans.

48

Vermont does not allow variation in plan premiums based on age and so was not

included in these comparisons.

49

As would be expected, this difference was consistent across Arizona plans for all three

age groups that we reviewed.

50

Similar to Arizona, this difference was consistent across North Carolina plans for all

three age groups that we reviewed.

Page 18 GAO-15-58 Small Business Health Insurance Exchanges

In the three states where we compared SHOP premiums to non-SHOP

small group market premiums in the state, we found that premiums for

silver-tier plans were generally comparable.

51

PPACA requires that prices

for identical plans within a given state be the same, regardless of whether

plans are offered on or off the SHOP.

52

Many stakeholders we spoke to

said that SHOP premiums were generally comparable to premiums for

plans outside of the SHOPs. As previously noted, PPACA requires that

small group plans meet a number of requirements. These requirements

limit the overall variability between PPACA-compliant plans offered within

or outside of the SHOPs, including variation in premiums.

Stakeholders we interviewed reported that the primary incentive for

employers to use the SHOPs has been the small business tax credit.

However, stakeholders identified several factors that may have hindered

enrollment, thus leading to current low SHOP enrollment. Stakeholders

also described factors that may help stimulate or detract from SHOP

enrollment in the future.

51

For California, the prices for non-SHOP plans were somewhat higher than the prices for

SHOP plans, with the lowest priced, the median priced, and the highest priced plan in the

non-SHOP market being somewhat higher than the lowest priced, the median priced, and

the highest priced plan in the California SHOP. For Illinois, the highest priced plan in the

non-SHOP market was somewhat more expensive than the highest priced plan in the

Illinois SHOP.

We requested data from the five states that we selected to interview state-level

stakeholders, California, Illinois, Kentucky, Rhode Island, and Texas. The necessary data

were not available within our timeframes from Kentucky and Texas.

52

PPACA, § 1301(a)(1)(C)(iii) (codified at 42 U.S.C. 18021(a)(1)(C)(iii)).

Stakeholders

Identified Several

Factors That May

Have Led to Current

Low SHOP

Enrollment and That

May Affect Future

Enrollment Growth

Page 19 GAO-15-58 Small Business Health Insurance Exchanges

Many stakeholders, including issuer, employer, and agent and broker

representatives we interviewed, reported that the primary incentive for

employers to use SHOPs has been the small business tax credit.

53

Employers must generally purchase coverage through a SHOP and meet

certain other criteria, including having fewer than 25 employees, to be

eligible for the credit, which they may receive for a maximum of two years

beginning in 2014. Most employer group representatives reported that

those small employers that were interested in and taking steps to enroll in

the SHOPs were largely doing so in order to be eligible for the tax credit.

Exchange officials in Kentucky also reported that the tax credit has likely

been an important incentive for small employers enrolling in the state’s

SHOP, and that most employers that had enrolled as of April 2014 had

less than 25 employees, indicating that they may have been pursuing the

credit.

54

Similarly, as discussed previously, we found that the average

number of enrolled employees in SB-SHOPs ranged from 1.6 to 8.3

employees,

55

However, several stakeholders noted that the tax credit is too small and

administratively complex to motivate many small employers to enroll.

CMS officials and one employer group representative noted that the

temporary nature of the tax credit—that is, the fact that employers may

receive the credit for only 2 years beginning in 2014—may deter some

employers from offering coverage for the first time through the SHOP to

obtain the credit. This is consistent with our prior work, which revealed

low use of the credit even prior to the establishment of the SHOPs. In

2012, we reported that the take-up of the small business tax credit in tax

year 2010, the first year the credit was offered, was much lower than the

estimated number of eligible employers. According to tax preparers and

other stakeholders we interviewed for that work, small employers likely

did not view the credit as a sufficient incentive to begin offering health

suggesting that many enrolled employers may have been

eligible for the credit.

53

The Internal Revenue Service has stated that in 2014, small employers in certain

counties in Wisconsin and Washington where SHOP plans are not offered may be eligible

for the tax credit if they offer coverage that would have qualified for the credit prior to

January 1, 2014.

54

Kentucky exchange officials noted that they cannot determine how many employers

have applied for or received the tax credit because the federal government, rather than

the state, handles tax credit applications.

55

Mississippi is a unique situation in that only one employer enrolled and so was not

included in this calculation.

Stakeholders Reported

that the Small Business

Tax Credit Has Been the

Primary Motivator for

Employers to Enroll in

SHOPs

Page 20 GAO-15-58 Small Business Health Insurance Exchanges

insurance, particularly given the complexity of, and time required to claim,

the credit.

56

Although the small business tax credit may have led some employers to

enroll in the SHOPs, stakeholders identified several other factors that

may have hindered enrollment, thus leading to current low SHOP

enrollment.

• Delays in key SHOP features. Stakeholders, including

representatives of national employer, agent and broker, and insurance

commissioner groups, said that the delays in implementation of online

enrollment and employee choice in the FF-SHOPs may have hindered

SHOP enrollment. These key features, which have also been delayed

in certain SB-SHOPs, are not typically available to small employers

purchasing coverage through other means. According to

stakeholders, until these key features are implemented, employers

may not have as much incentive to enroll in coverage through the

SHOP.

• Limited awareness of and misconceptions about SHOP

availability. Many stakeholders, including state exchange officials

and national- and state-level agent, broker, and employer

representatives, reported a lack of employer awareness of the ability

to enroll in SHOP plans beginning October 1, 2013, largely due to

misconceptions about whether the SHOPs were open for enrollment

and a lack of outreach by states and CMS. Stakeholders said that

media reports announcing delays in certain SHOP features—in

particular, the delays in FF-SHOP online enrollment and employee

choice—led many employers to assume that the overall

implementation of SHOPs was delayed and that enrolling in plans was

not yet possible. In addition, stakeholders said that low awareness

stemmed from a federal and state emphasis on highlighting the

availability of the individual exchanges. For example, exchange

officials from one SB-SHOP state noted that employer awareness of

56

See GAO, Small Employer Health Tax Credit: Factors Contributing to Low Use and

Complexity, GAO-12-549 (Washington, D.C.: May 14, 2012). CMS officials noted that the

agency launched a SHOP Small Business Health Care Tax Credit Estimator, available at

the federal exchange website, in early 2014 to ease administrative burden and help

employers better understand the tax credit. According to the officials, this tool is intended

to make it easier for employers to determine if they qualify for the tax credit as well as the

size of the credit they might receive.

Stakeholders Identified

Several Factors That May

Have Hindered Current

SHOP Enrollment

Page 21 GAO-15-58 Small Business Health Insurance Exchanges

the SHOP remained low in part because the state initially focused

outreach and marketing efforts on the individual exchange. However,

exchange officials from this and another SB-SHOP state reported that

with the end of their individual exchanges’ open enrollment periods,

the states are now focusing outreach and marketing efforts on their

SHOPs, which must provide for rolling enrollment.

57

• Renewal of existing, noncompliant plans. The majority of

stakeholders—including national-level groups as well as stakeholders

representing four of the five states included in our study—said that the

ability for employers to renew their existing, non-PPACA compliant

plans may have limited SHOP enrollment.

58

National-level employer

and agent and broker groups we interviewed said that most small

employers chose to renew their existing plans in states where this

was permitted, in part due to a general preference for the status quo,

as well as other factors, such as concerns about potential premium

increases associated with new plans.

59

• Technical challenges and administrative burden. Some

stakeholders said that the ongoing technical challenges and

administrative burden associated with many of the SHOPs have

served as a barrier to entry for employers, in part by discouraging

some agents and brokers from recommending the SHOP to

employers. National- and state-level employer group representatives

reported hearing from small employers that they have avoided SHOPs

due to technical challenges with SHOP websites, as well as

administrative burdens, such as difficulty reaching customer service

and, in some cases, the need to send application paperwork by mail.

State exchange officials reported that they worked closely with agents

Kentucky, California, and

Illinois exchange officials, as well as CMS officials who participated in

the implementation of the SHOP in Illinois and Texas, said that the

renewal of these plans may have limited SHOP enrollment in these

states.

57

The open enrollment period refers to the limited time frame when individuals are eligible

to enroll in QHPs through an individual exchange. Individuals may be eligible to enroll in

QHPs outside of the open enrollment period if they experience certain qualifying life

events.

58

Rhode Island exchange officials indicated that this factor was not applicable in Rhode

Island as it did not permit the renewal of non-PPACA-compliant plans in 2014.

59

In addition, press reports have suggested that some issuers may have encouraged their

customers to renew their noncompliant plans early, before SHOP enrollment and pricing

became available.

Page 22 GAO-15-58 Small Business Health Insurance Exchanges

and brokers to establish their SB-SHOPs, particularly given that most

small employers have traditionally relied on agents and brokers when

purchasing coverage for their employees. However, state exchange

officials and other stakeholders, including CMS officials, noted that

agents and brokers still faced challenges associated with using

SHOPs. These challenges included, in some cases, poor or

inaccessible customer service for brokers; poor training for brokers on

SHOP requirements; the extra time required to explain SHOP

requirements to clients; challenges receiving compensation; and the

lack of a dedicated broker “portal” on some SHOP websites that

would allow brokers to set up and help manage accounts for their

clients.

60

Agent and broker representatives from one state noted that

challenges such as these have led some agents and brokers to avoid

recommending that their small employer clients use the SHOP.

Despite the various factors that may have restrained SHOP enrollment to

date, many stakeholders noted that certain other factors suggest that the

SHOPs have the potential to experience future enrollment growth.

According to some stakeholders, central to enrollment growth will be the

phasing out of noncompliant plans, the resolution of the technical

challenges and reduction of the administrative burden cited as hampering

current enrollment, and the demonstration of a “value proposition” that

gives employers a reason for preferring SHOP-based coverage to

coverage available outside the SHOP. Stakeholders suggested several

additional factors that could help stimulate future SHOP enrollment

growth.

• Improved coordination with agents and brokers. Stakeholders,

including CMS officials, state exchange officials, and issuer,

employer, and agent and broker representatives, emphasized the

importance of coordinating with and providing improved web- or

phone-based tools to agents and brokers in order to facilitate SHOP

enrollment. States and CMS reported taking steps to resolve certain

challenges faced by agents and brokers when using the SHOP. For

example, Kentucky exchange officials said that they are working to

develop a tool that will allow agents and brokers to easily provide

60

The FF-SHOPs offered customer service phone lines, but not broker portals; however,

CMS officials indicated that FF-SHOPs will offer broker portals when online enrollment

begins in November 2014.

Stakeholders Identified

Various Factors That Have

the Potential to Contribute

to or Detract from Future

SHOP Enrollment Growth

Page 23 GAO-15-58 Small Business Health Insurance Exchanges

price quotes across multiple SHOP plans to their clients, and are

considering allowing SHOP-certified agents and brokers to initiate

applications on behalf of employers. Illinois exchange officials

reported developing a dedicated section for agents and brokers on the

state’s SHOP website through which agents and brokers can obtain

updated information on the SHOP, in response to feedback from

agent and broker community leaders. CMS officials said that

establishing a broker portal for the FF-SHOPs is a key agency priority,

and that the agency plans to have a broker portal in place when FF-

SHOP online enrollment becomes available in fall 2014. According to

CMS officials, the portal will, among other functions, allow agents and

brokers to search for and communicate with employer clients; monitor

employees’ enrollment progress; make changes to employee rosters;

and receive messages regarding employers’ monthly invoices,

including any late payment warnings.

61

• Availability of employee choice. Some stakeholders stated that the

employee choice feature, when fully implemented in all states, will be

a key value proposition for the SHOPs. For instance, CMS officials

said that employers will likely value being able to offer employees a

choice from among multiple plan and issuer options—an ability that

small employers typically have not been able to offer. Employer group

representatives reported that their members consider employee

choice to be an important benefit of the SHOPs, as employees will be

able to decide on their own the coverage that best suits their needs

and, if necessary, will have the option to spend more to purchase

more comprehensive plans. Evidence from Kentucky and Rhode

Island, whose SHOPs offer, but do not require, the use of employee

choice, further suggests that employers may value this feature. As

discussed previously, according to state exchange officials, the

majority of employers in Kentucky and Rhode Island that enrolled in

the SHOPs chose to offer their employees the choice of multiple

plans.

62

However, some issuer representatives and other stakeholders were

uncertain about the value of employee choice, noting that it is

61

Employee rosters contain information, such as names and dates of birth, for each

employee to whom SHOP coverage is offered.

62

According to CMS officials, data reported to CMS by two additional SB-SHOP states—

Colorado and New York—indicate that the majority of employers using the SHOP in those

states have chosen to offer employee choice.

Page 24 GAO-15-58 Small Business Health Insurance Exchanges

challenging for issuers to implement and that too many choices may

be overwhelming for employers and employees. Representatives from

national issuer and insurance commissioner groups reported that it is

time consuming and expensive for issuers to build the information

technology systems required for premium aggregation and other

issuer-specific functions necessary for employee choice. In addition,

issuers and other stakeholders have reported concerns regarding

whether employee choice would lead to adverse selection among

plans in the SHOP—a concern that has, in part, led some states to

delay their implementation of employee choice until 2016.

• Increased marketing to employers. Some stakeholders said that

states need to better market the SHOP to small employers to increase

SHOP awareness. Some employer group representatives said states

need to improve outreach by more aggressively targeting small

employers and highlighting the value of the SHOPs in their marketing.

Exchange officials in one state emphasized the importance of

marketing the SHOPs to small employers as a product that offers

value, rather than performing traditional outreach, which is more

characteristic of public programs. The officials also noted that

marketing must be conducted continuously throughout the year, given

that employers renew their coverage at different points in the year.

• Robust issuer participation. Although stakeholders representing

four of the five states included in our study reported that issuer

participation has not been a challenge, CMS officials said that robust

issuer participation will be important in ensuring the SHOPs’ long-term

viability. Issuer representatives noted that, due to the requirement that

certain issuers must participate in a state’s FF-SHOP if they wish to

participate in its federally facilitated individual exchange, some issuers

will be required to participate in the SHOPs.

63

63

78 Fed. Reg. 15410, 15535 (Mar. 11, 2013) (to be codified at 45 C.F.R. § 156.200(g)).

In addition, some SB-SHOPs require that issuers meeting certain requirements participate

in the state’s SHOP.

However, according to

the representatives, other issuers may be hesitant to participate given

factors such as uncertainties regarding delays in SHOP functionality

and technical readiness; potential new requirements, such as those

related to the adequacy of provider networks; the expense and

complexity of implementing employee choice and other SHOP

features; and the ability for employers to renew noncompliant plans.

CMS officials said that although some issuers may be reluctant to

Page 25 GAO-15-58 Small Business Health Insurance Exchanges

participate in the FF-SHOPs in the early years of implementation,

once information technology systems have been fully developed and

refined, issuers may be more eager to participate.

• Expansion of the SHOPs to larger employers. Exchange officials in

one state noted that as eligibility for SHOP enrollment expands to

employers with up to 100 employees—which must occur no later than

January 1, 2016—and, eventually, to larger employers in some states,

additional employers may consider the SHOP as an option for

purchasing coverage.

64

• Financial sustainability of the SHOPs. Exchange officials in one

state noted that an essential element of SHOP viability will be

ensuring the SHOPs are financially sustainable.

However, based on the small average number

of employees per employer enrolled in SB-SHOPs, it remains to be

seen whether larger employers will enroll when given the opportunity.

65

64

CMS officials said that as of September 2014 they were not aware of any states that

were planning to expand the SHOP to employers with 51 to100 employees in 2015.

They and other SB-

SHOP exchange officials we interviewed said that their states have

proposed or finalized funding mechanisms in place. In two of the

states, these funding mechanisms will draw from either all exchange

plans—both individual and SHOP—or all health plans in the state;

therefore, low initial SHOP enrollment is not likely to significantly

Beginning in 2015, employers with 100 or more employees that do not offer affordable

health coverage to 70 percent or more of their employees may be subject to a penalty if at

least one employee receives subsidized coverage through an exchange. Beginning in

2016, employers with 50 or more employees that do not offer affordable health coverage

to their full-time employees may be subject to this penalty if at least one employee

receives subsidized coverage through an exchange. PPACA, § 1513(a). 124 Stat. at 253

(codified at 26 U.S.C. § 4980H); 79 Fed. Reg. 8544, 8575, 8597-8601 (Feb. 12, 2014) (to

be codified at 26 C.F.R. §§ 54.4980H-4, 54.4980H-5). Therefore, as SHOP eligibility

expands to larger employers and these penalties take effect, more employers may be

likely to participate in the SHOP.

65

States operating SB-SHOPs are required to ensure that the SHOPs are self-sustaining

by January 1, 2015, meaning that states must ensure their SHOPs have sufficient funding