Dakota County CDA

Board of Commissioners

Special Board Meeting Agenda

Meeting Date: February 28, 2024 2:00 PM CDA Boardroom, Eagan, MN

1. Call To Order And Roll Call

2. Audience

Anyone wishing to address the CDA Board on an item not on the agenda, or an item on the

651-675-4434) and instructions will be given to participate during the meeting or provide written

comments. Verbal comments are limited to five minutes.

3. Oath Of Office – Commissioner Laurie Halverson, District 3

4. Election Of 2024 Board Secretary

5. Approval Of Agenda And Meeting Minutes

A. Approval Of Meeting Minutes – January 24, 2023 Annual Meeting 3

B. Approval Of Meeting Minutes – January 24, 2023 Regular Meeting 7

6. Federal Public Housing And Housing Choice Voucher

No items.

7. Consent Agenda

A. Approval Of Record Of Disbursements – January 2024 14

B. Award Contract For Access Control Replacement At Carmen Court (Inver Grove

Heights) And The Dakotah (West St. Paul)

16

C. Establish The Date For A Public Hearing On Qualified Allocation Plan For The

Allocation Of 2025 Low Income Housing Tax Credits

21

D. Approval Of Amendments To Personnel Policy #295 – Flex Leave Donation 24

1

Meeting Date: February 28, 2024 2:00 PM CDA Boardroom, Eagan, MN

8. Regular Agenda

A. Public Hearing To Receive Comments And Approve Conveyance Of Land To

The Denmark Trail Workforce Housing Limited Partnership (Denmark Trail

Townhomes, Farmington)

31

B. Approval Of Contingent HOME American Rescue Plan Award To 360

Communities Lewis House Shelter (Eagan)

34

C. Discussion Of Proposed Changes To The 2025 Qualified Allocation Plan For

Low Income Housing Tax Credits

50

D. Legislative Update

65

E. Executive Director Update

9. Information

10. Adjournment

For more information, call 651-675-4434.

Dakota County CDA Board meeting agendas are available online at:

http://www.dakotacda.org/board_of_commissioners.htm

Next Meeting

March 27, 2024

CDA Board of Commissioners Regular Meeting – 1:00 p.m.

Dakota County CDA Boardroom, 1228 Town Centre Drive, Eagan, MN 55123

March 27, 2024

CDA Board of Commissioners Housing Strategic Plan Workshop – 2:00 p.m.

Dakota County CDA Boardroom, 1228 Town Centre Drive, Eagan, MN 55123

2

Board of Commissioners

Meeting Minutes

Meeting Date: January 24, 2024 1:00 PM Boardroom; CDA Office, Eagan, MN

Commissioner Slavik called the meeting to order at 1:00 p.m.

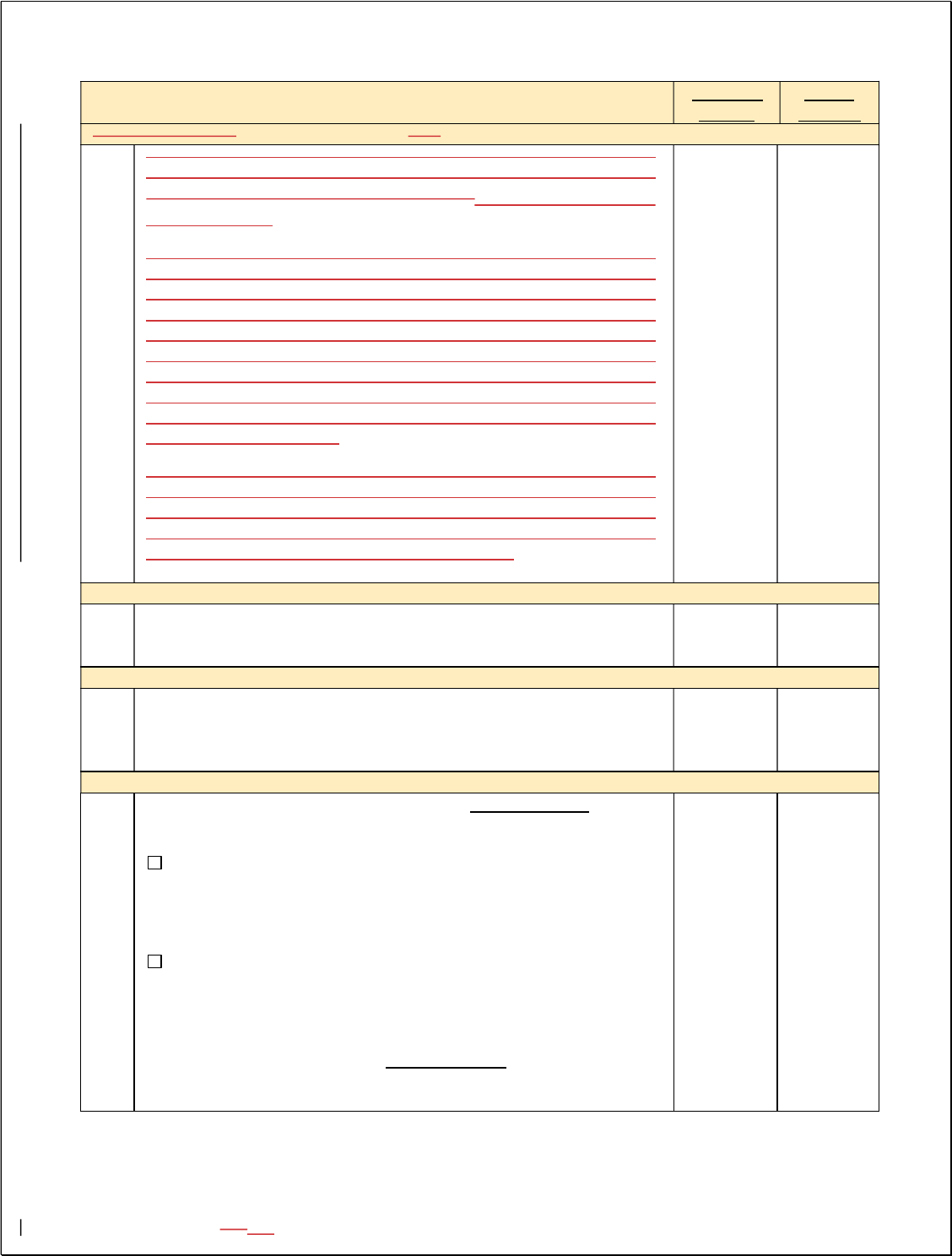

COMMISSIONER ROLL CALL

CDA staff in attendance:

Tony Schertler, Executive Director

Kari Gill, Deputy Executive Director

Sara Swenson, Director of Administration and Communications

Sarah Jacobson, Administrative Coordinator

Lisa Alfson, Director of Community & Economic Development

Maggie Dykes, Assistant Director of Community & Economic Development

Lisa Hohenstein, Director of Housing Assistance

Travis Finlayson, Assistant Director of Housing Assistance

Anna Judge, Director of Property Management

Others in attendance:

Lucie O’Neill, Dakota County Attorney’s Office

Madeline Kastler, Dakota County

Mary Dobbins

OATHS OF OFFICE

Commissioners Slavik & Hamann-Roland read their Oaths of Office and were seated on the CDA

Board of Commissioners.

REGULAR AGEN

24-6782

Electing The Chair For The Dakota County Community Development Agency

Board of Commissioners

WHEREAS, Commissioner Slavik opened the Annual Meeting as Board Chair; and

WHEREAS, nominations were accepted for the office of Chair; and

Present Absent

Commissioner Slavik, District 1

X

Commissioner

A

tkins, District 2

X

Commissioner Halverson, District 3

X

Commissioner Droste, District 4

X

Commissioner Workman, District 5

X

Commissioner Holber

g

, District 6

X

Commissioner Hamann-Roland, District 7

X

Commissioner Velikolan

g

ara, At Lar

g

e

X

3

WHEREAS, Commissioner Hamann-Roland placed in nomination Commissioner

Slavik; and

WHEREAS, no further nominations were placed; and

WHEREAS, Commissioner Slavik closed nominations for the office of Chair; and

WHEREAS, Commissioner Hamann-Roland moved the ballot and Commissioner

Droste seconded and a vote was taken on Commissioner Slavik acting as chair and

the motion was carried.

NOW, THEREFORE, BE IT RESOLVED by the Dakota County Community

Development Agency Board of Commissioners, that Commissioner Slavik serve as

Chair for calendar year 2024.

Motion: Commissioner Hamann-Roland

Second: Commissioner Droste

Ayes: 7

Nays: 0 Abstentions: 0

Yes No Absent Abstain

Slavi

k

X

A

tkins

X

Halverson

X

Droste

X

Workman

X

Holber

g

X

Hamann-Roland

X

Velikolan

g

ara

X

24-6783

Electing The Vice-Chair For The Dakota County Community Development

A

g

enc

y

Board of Commissioners

WHEREAS, nominations were accepted for the office of Vice Chair; and

WHEREAS, Commissioner Atkins placed in nomination Commissioner Hamann-

Roland; and

WHEREAS, no further nominations were placed; and

WHEREAS, Commissioner Slavik closed nominations for the office of Vice Chair;

and

WHEREAS, Commissioner Atkins moved the ballot and Commissioner Workman

seconded and a vote was taken on Commissioner Hamann-Roland acting as Vice

Chair and the motion was carried.

NOW, THEREFORE, BE IT RESOLVED by the Dakota County Community

Development Agency Board of Commissioners, that Commissioner Hamann-Roland

serve as Vice Chair for calendar

y

ear 2024.

4

Motion: Commissioner Atkins

Second: Commissioner Workman

Ayes: 7

Nays: 0 Abstentions: 0

Yes No Absent Abstain

Slavi

k

X

A

tkins

X

Halverson

X

Droste

X

Workman

X

Holber

g

X

Hamann-Roland

X

Velikolan

g

ara

X

24-6784 Selection of GREATER MSP Board Appointment

WHEREAS, the Dakota County Community Development Agency is an investor of

GREATER MSP; and

WHEREAS, as part of the investment, the CDA Board appoints a Commissioner to

represent Dakota County on the GREATER MSP Board; and

WHEREAS, Commissioner Hamann-Roland placed in nomination Commissioner

Slavik; and

WHEREAS, no further nominations were placed; and

NOW, THEREFORE, BE IT RESOLVED by the Dakota County Community

Development Agency Board of Commissioners, that Commissioner Slavik is

recommended to serve on the GREATER MSP Board for 2024.

Motion: Commissioner Hamann-Roland

Second: Commissioner Droste

Ayes: 7

Nays: 0 Abstentions: 0

Yes No Absent Abstain

Slavi

k

X

A

tkins

X

Halverson

X

Droste

X

Workman

X

Holber

g

X

Hamann-Roland

X

Velikolan

g

ara

X

24-6785 Ad

j

ournment

5

BE IT RESOLVED, that the Dakota County Community Development Agency Board

of Commissioners hereby adjourns to the Dakota County Development Agency

Board of Commissioners Re

g

ular Meetin

g

.

Motion: Commissioner Atkins

Second: Commissioner Workman

Ayes: 7

Nays: 0 Abstentions: 0

Yes No Absent Abstain

Slavi

k

X

A

tkins

X

Halverson

X

Droste

X

Workman

X

Holber

g

X

Hamann-Roland

X

Velikolan

g

ara

X

6

Board of Commissioners

Meeting Minutes

Meeting Date: January 24, 2024 1:15 PM Boardroom; CDA Office, Eagan, MN

Commissioner Slavik called the meeting to order at 1:15 p.m.

COMMISSIONER ROLL CALL

CDA staff in attendance:

Tony Schertler, Executive Director

Kari Gill, Deputy Executive Director

Sara Swenson, Director of Administration and Communications

Sarah Jacobson, Administrative Coordinator

Lisa Alfson, Director of Community & Economic Development

Maggie Dykes, Assistant Director of Community & Economic Development

Lisa Hohenstein, Director of Housing Assistance

Travis Finlayson, Assistant Director of Housing Assistance

Anna Judge, Director of Property Management

Others in attendance:

Lucie O’Neill, Dakota County Attorney’s Office

Madeline Kastler, Dakota County

Mary Dobbins

AUDIENCE

No audience members addressed the Board

APPROVAL OF AGENDA AND MEETING MINUTES

24-6786 Approval Of A

g

enda And Meetin

g

Minutes

BE IT RESOLVED, by the Dakota County Community Development Agency Board of

Commissioners that the agenda for the January 24, 2024 Regular CDA Board meeting

be approved as written.

BE IT FURTHER RESOLVED b

y

the Dakota Count

y

Communit

y

Development

Present Absent

Commissioner Slavik, District 1

X

Commissioner

A

tkins, District 2

X

Commissioner Halverson, District 3

X

Commissioner Droste, District 4

X

Commissioner Workman, District 5

X

Commissioner Holber

g

, District 6

X

Commissioner Hamann-Roland, District 7

X

Commissioner Velikolan

g

ara, At Lar

g

e

X

7

Agency Board of Commissioners that the minutes for the December 19, 2023 Regular

Board meeting be approved as written.

Motion: Commissioner Hamann-Roland

Second: Commissioner Droste

Ayes: 7

Nays: 0 Abstentions: 0

Yes No Absent Abstain

Slavi

k

X

A

tkins

X

Halverson

X

Droste

X

Workman

X

Holber

g

X

Hamann-Roland

X

Velikolan

g

ara

X

FEDERAL PUBLIC HOUSING AND HOUSING CHOICE VOUCHER AGENDA

CONSENT

24-6787

Approve 2024 Utility Allowance Schedule For The Housing Choice Voucher

Pro

g

ram

WHEREAS, the Dakota County Community Development Agency receives funding

through the Department of Housing and Urban Development (HUD) to operate a

Housing Choice Voucher Program; and

WHEREAS, in accordance with the 24 CFR 982.517, Housing Authorities are required

to establish and maintain allowance schedules for use in calculating estimated costs

of tenant-furnished utilities and other services; and

WHEREAS, the allowance schedule for tenant paid utilities and other services be

reviewed annually.

NOW, THEREFORE, BE IT RESOLVED by the Dakota County Community

Development Agency Board of Commissioners, That the Allowances for Tenant-

Furnished Utilities, Attachment A, is adopted for use in the Housing Choice Voucher

Pro

g

ram effective Februar

y

1, 2024.

24-6788

Schedule A Public Hearing To Receive Comments On The 2024 Public Housing

A

g

enc

y

Plan

WHEREAS, Section 511 of the Quality Housing and Work Responsibility Act

(QHWRA) of 1998 and the ensuing HUD requirement mandates that agencies with

Housing Choice Voucher and/or Public Housing programs once every five years

submit a Public Housing Agency (PHA) Five Year Strategic Plan and every year submit

a Public Housing Agency Annual Plan including the Capital Fund Program Annual

Statement and the Performance And Evaluation Report; and

WHEREAS, in 2024, the Dakota Count

y

Communit

y

Development A

g

enc

y

(

CDA

)

is

8

required to submit an Annual Plan; and

WHEREAS, Section 511 of the QHWRA of 1998 also requires that after a 45-day

public comment period, the Board of Commissioner of the agency responsible for the

PHA Plan conducts a public hearing; and

WHEREAS, the public comment period opened on January 12, 2024.

NOW, THEREFORE, BE IT RESOLVED by the Dakota County Community

Development Agency Board of Commissioners, That a public hearing for the PHA

A

nnual Plan will be conducted at the March 27, 2024 meetin

g

.

24-6789

Approval Of Amendments To The Housing Assistance Department

Administrative Plans

WHEREAS, the Dakota County Community Development Agency (CDA), as an

administrator of rental assistance programs, is required to adopt and maintain an

administrative plan to delineate the policies used to govern the programs; and

WHEREAS, the Dakota County CDA has made updates to the Housing Assistance

Department Administrative Plans to include policies for the Dakota County Voucher

Rental Assistance Program.

NOW, THEREFORE, BE IT RESOLVED by the Dakota County Community

Development Agency Board of Commissioners, That the amendments to the Housing

A

ssistance Department Administrative Plans are approved.

Motion: Commissioner Velikolangara

Second: Commissioner Workman

Ayes: 7

Nays: 0 Abstentions: 0

Yes No Absent Abstain

Slavi

k

X

A

tkins

X

Halverson

X

A

tkins

X

Workman

X

Holber

g

X

Hamann-Roland

X

Velikolan

g

ara

X

CONSENT AGENDA

24-6790 Approval Of Record Of Disbursements

–

December 2023

BE IT RESOLVED by the Dakota County Community Development Agency Board of

Commissioners, That the December 2023 Record of Disbursements is approved as

written.

9

24-6791

Establish The Date For A Public Hearing To consider Conveyance Of Property

To Denmark Trail Workforce Housing Limited Partnership (Denmark Trail

Townhomes, Farmin

g

ton

)

WHEREAS, the Dakota County CDA has acquired property located in Farmington,

Minnesota, legally described as follows:

That part of the West half of the Northwest Quarter (W 1/2 of NW 1/4) in

Section 6, Township 113, Range 19, Dakota County, Minnesota, lying

Northerly of the Northerly right-of-way of Chicago, Milwaukee, St. Paul and

Pacific Railroad, except the two parcels described as follows:

Parcel A:

The East 597.97 feet of the West half of the Northwest Quadrant (W 1/2 of

NW 1/4) in Section 6, Township 113, Range 19, Dakota County, Minnesota,

lying Northerly of the Northerly right-of-way of Chicago, Milwaukee, St. Paul

and Pacific Railroad.

Parcel B:

The North 1338.34 feet of the West half of the Northwest Quarter (W 1/2 of

NW 1/4) in Section 6, Township 113, Range 19, Dakota County, Minnesota,

lying West of the East 597.97 feet thereof.

To be re-platted as lot 1, Block 1 Denmark Housing Addition, Dakota County,

Minnesota; and

WHEREAS, the CDA desires to promote the development of Denmark Trail

Townhomes, a housing development project comprised of 40 townhome units which

has received an allocation of low income housing tax credits, by the Denmark Trail

Workforce Housing Limited Partnership, in which the CDA is the sole general partner

(the “Partnership”); and

WHEREAS, pursuant to Minnesota Statutes 469.029, the Dakota County CDA must

hold a public hearing prior to conveyance of real property; and

WHEREAS, notice of such public hearing will be provided in a newspaper with local

distribution in accordance with Minnesota Statutes 469.029.

NOW, THEREFORE, BE IT RESOLVED by the Dakota County Community

Development Agency Board of Commissioners, That the date for a public hearing to

consider the conveyance of real property to the Partnership be established for

February 28, 2024, at or after 1 p.m. at the office of the Dakota County CDA located

at 1228 Town Centre Drive in Ea

g

an, Minnesota.

24-6792

Authorize Forgiveness And Release Of CDA Tax Increment Financing Loan

And Interest to Spruce Pointe Townhomes

(

Inver Grove Hei

g

hts

)

WHEREAS, in 1995 the Dakota County Housing and Redevelopment Authority, now

the Dakota Count

y

Communit

y

Development A

g

enc

y

(

CDA

)

, approved a $200,000

10

Tax Increment Financing (TIF) Loan to assist with construction of Spruce Pointe

Townhomes, a 24-unit development in Inver Grove Heights; and

WHEREAS, Spruce Pointe Townhomes is now owned by the Dakota County CDA

Workforce Housing, LLC; and

WHEREAS, the current balance of the TIF loan, including interest, is $180,465; and

WHEREAS, the CDA wishes to forgive and release the remaining balance and

interest on the TIF Loan to ensure the long-term affordability of Spruce Pointe

Townhomes.

NOW, THEREFORE, BE IT RESOLVED by the Dakota County Community

Development Agency Board of Commissioners, That the remaining balance and

interest of a Tax Increment Financing Loan for Spruce Pointe Townhomes in the

amount of $180,465 is hereby forgiven and released, and the Executive Director is

hereby authorized and directed to execute and deliver on behalf of the CDA those

documents that may be necessary or convenient to evidence such forgiveness and

release.

24-6793

Approval Of Budget Amendment For Tax Increment Financing District No. 11

For Glazier Townhomes

(

Apple Valle

y)

WHEREAS, in 1983, the Dakota County Housing and Redevelopment Authority, now

the Dakota County Community Development Agency (CDA), constructed Glazier

Townhomes, a 15-unit public housing development located at 14631-14659 Glazier

Avenue; and

WHEREAS, public sidewalks were not required to be installed when Glazier

Townhomes were developed; and

WHEREAS, the City of Apple Valley is undertaking a public improvement project in

2024 to construct missing public sidewalks in the city’s downtown area; and

WHEREAS, the City has requested the CDA participate in the costs for the

installation of the public sidewalk that would be constructed on west side of Glazier

Avenue adjacent to Glazier Townhomes; and

WHEREAS, the City has stated the CDA’s share of the public sidewalk construction

would not exceed $70,000; and

WHEREAS, there are available funds for the construction of public sidewalks from

Tax Increment Financing District No. 11 in Apple Valley.

NOW, THEREFORE, BE IT RESOLVED by the Dakota County Community

Development Agency Board of Commissioners, That the fiscal year 2024 operating

budget be amended to include up to $70,000 of budget authority in Tax Increment

Financing District No. 11 for the construction of public sidewalks adjacent to Glazier

Townhomes in Apple Valle

y

.

11

24-6794

Summary Of Conclusions Of Closed Executive Session To Evaluate

Performance Of Executive Director

WHEREAS, pursuant to Minn. Stat. § 13D.05, subd. 3(a), the CDA Board held a

closed executive session on December 19, 2023, to evaluate the performance of the

CDA Executive Director; and

WHEREAS, § 13D.05, subd. 3(a) requires that the CDA Board summarize its

conclusions regarding the evaluations; and

WHEREAS, the CDA Executive Director’s rating was based on four Annual Goals

and Annual Priorities elements (Internal, Stakeholder, Financial, and Learning and

Growth Perspectives); and

WHEREAS, the rating was also based upon ten established Core Competencies,

including Strategic Agility; Communicating Vision & Purpose; Analytical Thinking &

Planning; Decision Making; Listening-Communications Skills; Handling Conflict &

Difficult Situations; Organizational Expertise; Working with Others & Teams; Honesty

& Integrity; and Impact on Results.

NOW, THEREFORE, BE IT RESOLVED by the Dakota County Community

Development Agency Board of Commissioners, That based upon a review of the

Executive Director’s performance with respect to the Annual Goals and Annual

Priorities elements and Core Competencies, the Executive Director’s annual

performance is rated at the level of Exceeds Standards, and is approved for a 6.5%

pa

y

increase effective Januar

y

1, 2024.

Motion: Commissioner Hamann-Roland

Second: Commissioner Atkins

Ayes: 6

Nays: 0 Abstentions: 0

Yes No Absent Abstain

Slavi

k

X

A

tkins

X

Halverson

X

Droste

X

Workman

X

Holber

g

X

Hamann-Roland

X

REGULAR AGENDA

A

. Housin

g

Development Update

Kari Gill presented.

B. Le

g

islative Update

Anna Judge, Mar

y

Dobbins and Ton

y

Schertler presented.

C. Executive Director Update

Ton

y

Schertler presented.

12

INFORMATION

A

. Status Report, Q4 2023

B. Open To Business Report, Q4 2023

ADJOURNMENT

24-6795 Ad

j

ournment

BE IT RESOLVED, that the Dakota County Community Agency Board of

Commissioners hereb

y

ad

j

ourns until Wednesda

y

, Februar

y

28, 2024.

Motion: Commissioner Hamann-Roland Second: Commissioner Droste

Ayes: 7 Nays: 0 Abstentions: 0

Yes No Absent Abstain

Slavi

k

X

A

tkins

X

Halverson

X

Droste

X

Workman

X

Holber

g

X

Hamann-Roland

X

Velikolan

g

ara

X

The CDA Board meeting adjourned at

2

:

2

8

p

.m.

__________________________________________

Clerk to the Board

13

Board of Commissioners

Request for Board Action

Meeting Date: February 28, 2024 Agenda #: 7A

DEPARTMENT: Finance

FILE TYPE: Regular - Consent

TITLE

..title

Approval Of Record Of Disbursements – January 2024

..end

PURPOSE/ACTION REQUESTED

Approve Record of Disbursements for January 2024.

SUMMARY

In January 2024, the Dakota County Community Development Agency (CDA) had $7,995,059.51 in

disbursements and $663,919.51 in payroll expenses. Attachment A provides the breakdown of

disbursements. Additional detail is available from the Finance Department.

RECOMMENDATION

..recommendati on

Staff recommends approval of the Record of Disbursements for January 2024.

..end

EXPLANATION OF FISCAL/FTE IMPACTS

These disbursements are included in the Fiscal Year Ending June 30, 2024 budget.

☐ None ☒ Current budget ☐ Other ☐ Amendment Requested ☐ New FTE(s) requested

RESOLUTION

..body

BE IT RESOLVED by the Dakota County Community Development Agency Board of Commissioners,

That the January 2024 Record of Disbursements is approved as written.

PREVIOUS BOARD ACTION

N/A

ATTACHMENTS

Attachment A: Record of Disbursements – January 2024

BOARD GOALS

☐ Focused Housing Programs ☐ Collaboration

☐ Development/Redevelopment ☒ Financial Sustainability ☒ Operational Effectiveness

CONTACT

Department Head: Ken Bauer, Finance Director

Author: Chris Meyer, Assistant Director of Finance

14

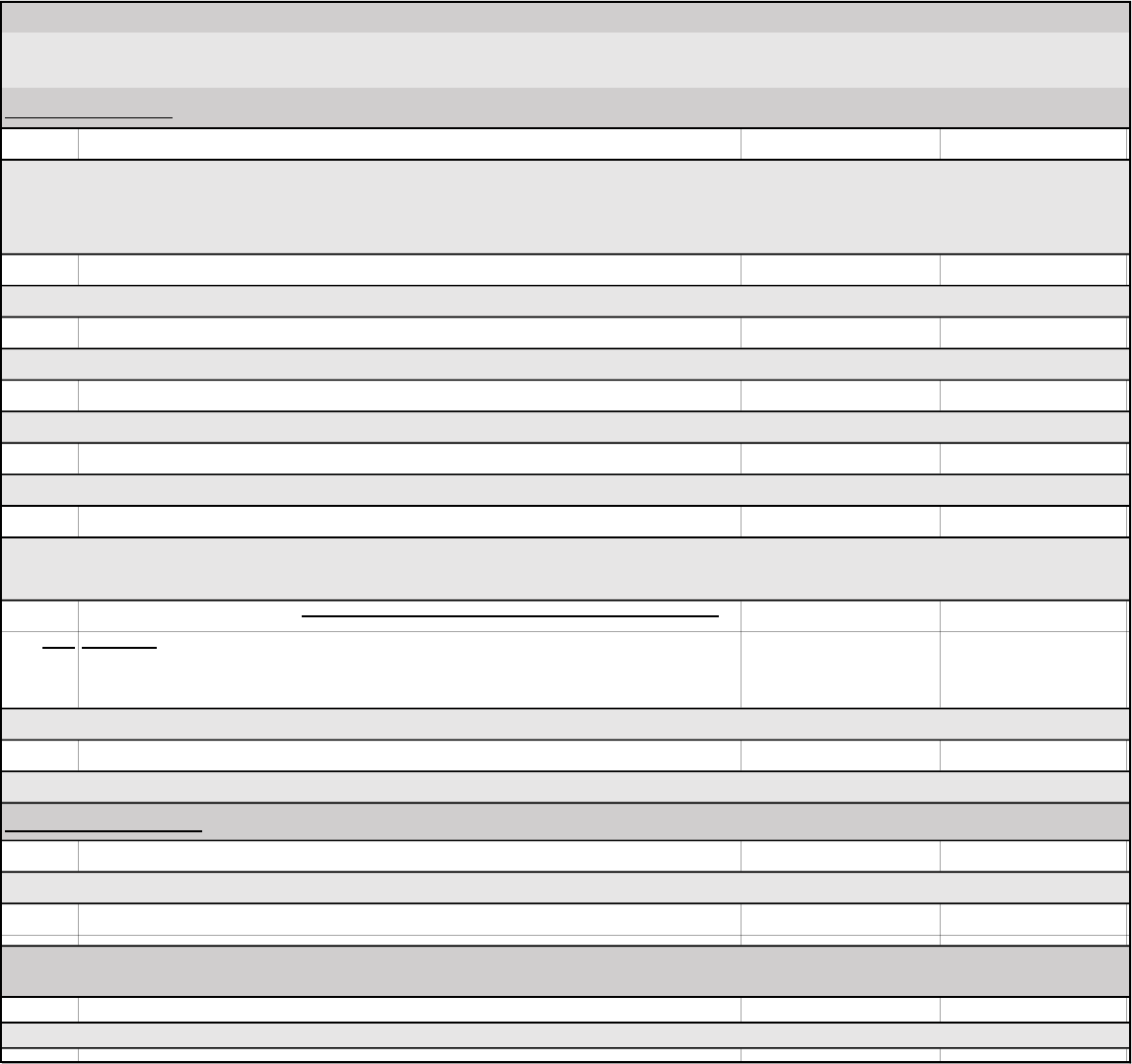

Date Amount Total

Common Bond Housing

01/19/24 16,246.38$

16,246.38$

Disbursing

01/01/24 2,429.00$

01/04/24 542,195.67$

01/11/24 445,961.58$

01/18/24 751,136.71$

01/25/24 685,537.38$

2,427,260.34$

HOME

01/05/24 5,000.00$

5,000.00$

HOPE Program

01/30/24 18,000.00$

18,000.00$

Housing Assistance

01/01/24 2,528,604.01$

01/18/24 199,948.78$

2,728,552.79$

Tax Levy

01/19/24 2,800,000.00$

2,800,000.00$

Total Disbursements 7,995,059.51$

January 2024 Payroll

01/12/24 271,093.15$

01/26/24 392,826.36$

Total Payroll 663,919.51$

Disbursement detail is available in the Finance Office

Dakota County CDA

Record of Disbursements

For the month of January 2024

7A - Attachment A

15

Board of Commissioners

Request for Board Action

Meeting Date: February 28, 2024 Agenda #: 7B

DEPARTMENT: Housing Development

FILE TYPE: Regular - Consent

TITLE

..title

Award Contract For Access Control Replacement At Carmen Court (Inver Grove Heights) and

The Dakotah (West St. Paul)

..end

PURPOSE/ACTION REQUESTED

Authorize Deputy Executive Director to execute a contract for Access Control Replacement at

Carmen Court and The Dakotah senior housing Developments.

Authorize Change Order Authority.

SUMMARY

This contract is for the replacement of failing locks at Carmen Court and The Dakotah senior housing

developments. This is part of a long-term plan to roll out new technology over the course of the next

several years and to replace the existing failing and obsolete locks.

On January 5, 2024 at 10 a.m. a public bid opening was conducted at the Dakota County CDA office

for this project. Five contractors were solicited to bid on the project in addition to being publicly

advertised (Attachment A) and posted on the CDA’s website. Two contractors showed interest by

attending a site walk-though; one other responded that they were interested but too busy at this time.

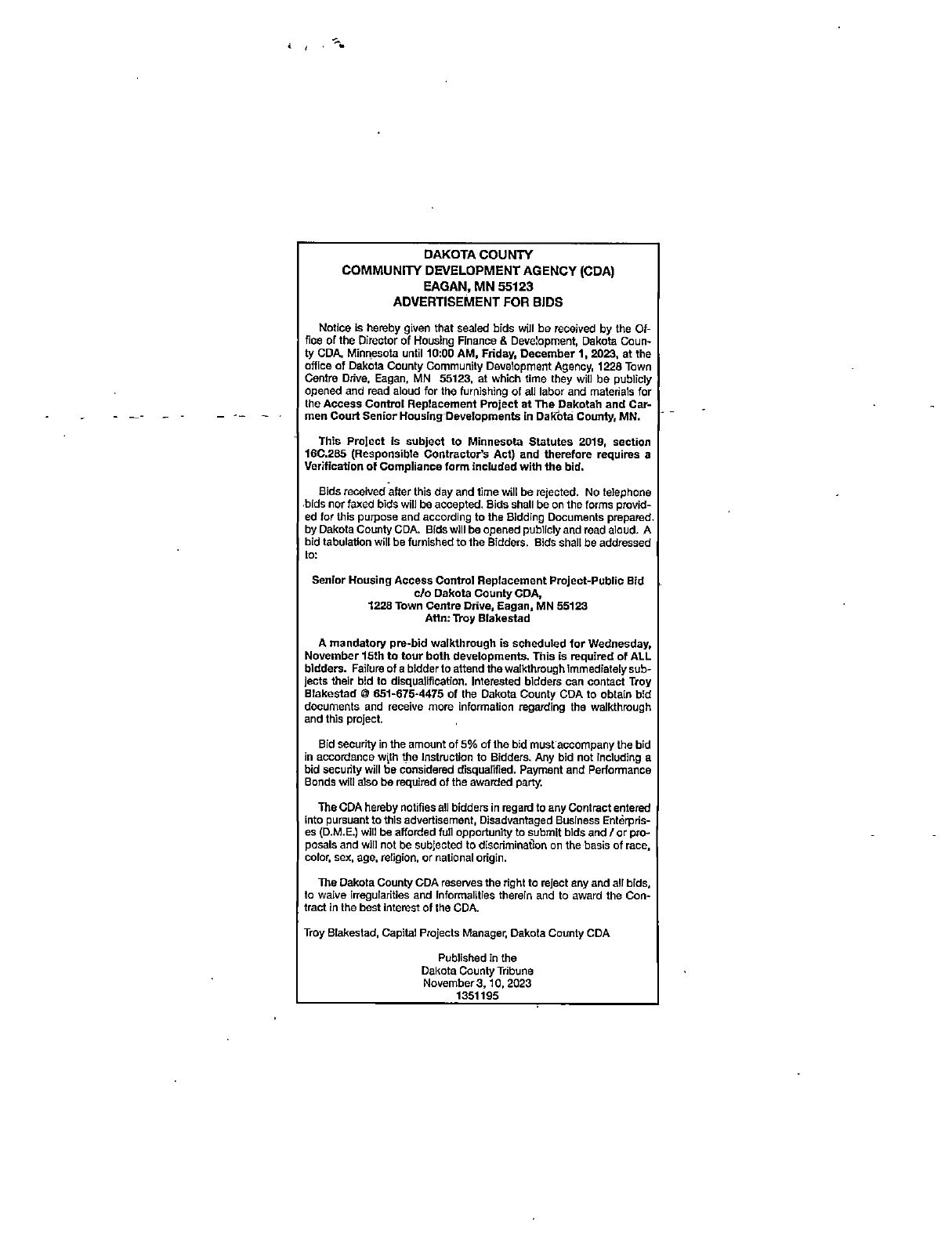

One bid was received from Assured Security; the bid tabulation is Attachment B.

The contract price is $218,424.12 and there are funds available for this project in the current

Extraordinary Maintenance budget.

It is expected that the project would begin by May and be completed by June 2024.

RECOMMENDATION

..recommendati on

It is recommended that the Deputy Executive Director be authorized to enter into a contract with

Assured Security in the amount of $218,424.12 and be authorized to sign change orders in an

amount not to exceed $10,921 (this is 5% of the contract amount). The solicitation of bids was done

in accordance with public bidding requirements and the contractor has successfully completed nine

similar projects for the CDA in the past.

..end

EXPLANATION OF FISCAL/FTE IMPACTS

The $229,345.24 (contract plus potential change order authority) will be funded from the FYE24

Extraordinary Maintenance Budget.

☐ None ☒ Current budget ☐ Other ☐ Amendment Requested ☐ New FTE(s) requested

16

Meeting Date: February 28, 2024 Agenda #: 7B

RESOLUTION

..body

WHEREAS, formal bids were received on January 5, 2024 for the Access Control project at Carmen

Court and The Dakotah senior housing developments in Dakota County; and

WHEREAS, Assured Security submitted a responsive bid of $218,424.12; and

WHEREAS, the contract is being recommended by Property Management due to immediate need

and the contractor is being recommended on their prior experience on similar projects with the CDA;

and

WHEREAS, funds are available in the current Extraordinary Maintenance budget for this project; and

NOW, THEREFORE BE IT RESOLVED by the Dakota County Community Development Agency

Board of Commissioners, That the Deputy Executive Director be authorized to sign a construction

contract with Assured Security in the amount of $218,424.12; and

BE IT FURTHER RESOLVED, that the Deputy Executive Director be authorized to approve change

orders in an amount not to exceed $10,921.

PREVIOUS BOARD ACTION

N/A

ATTACHMENTS

Attachment A: Public Advertisement

Attachment B: Bid Tabulation

BOARD GOALS

☐ Focused Housing Programs ☐ Collaboration

☐ Development/Redevelopment ☐ Financial Sustainability ☒ Operational Effectiveness

CONTACT

Department Head: Kari Gill, Deputy Executive Director

Author: Troy Blakestad, Capital Projects Manager

17

7B - Attachment A

18

19

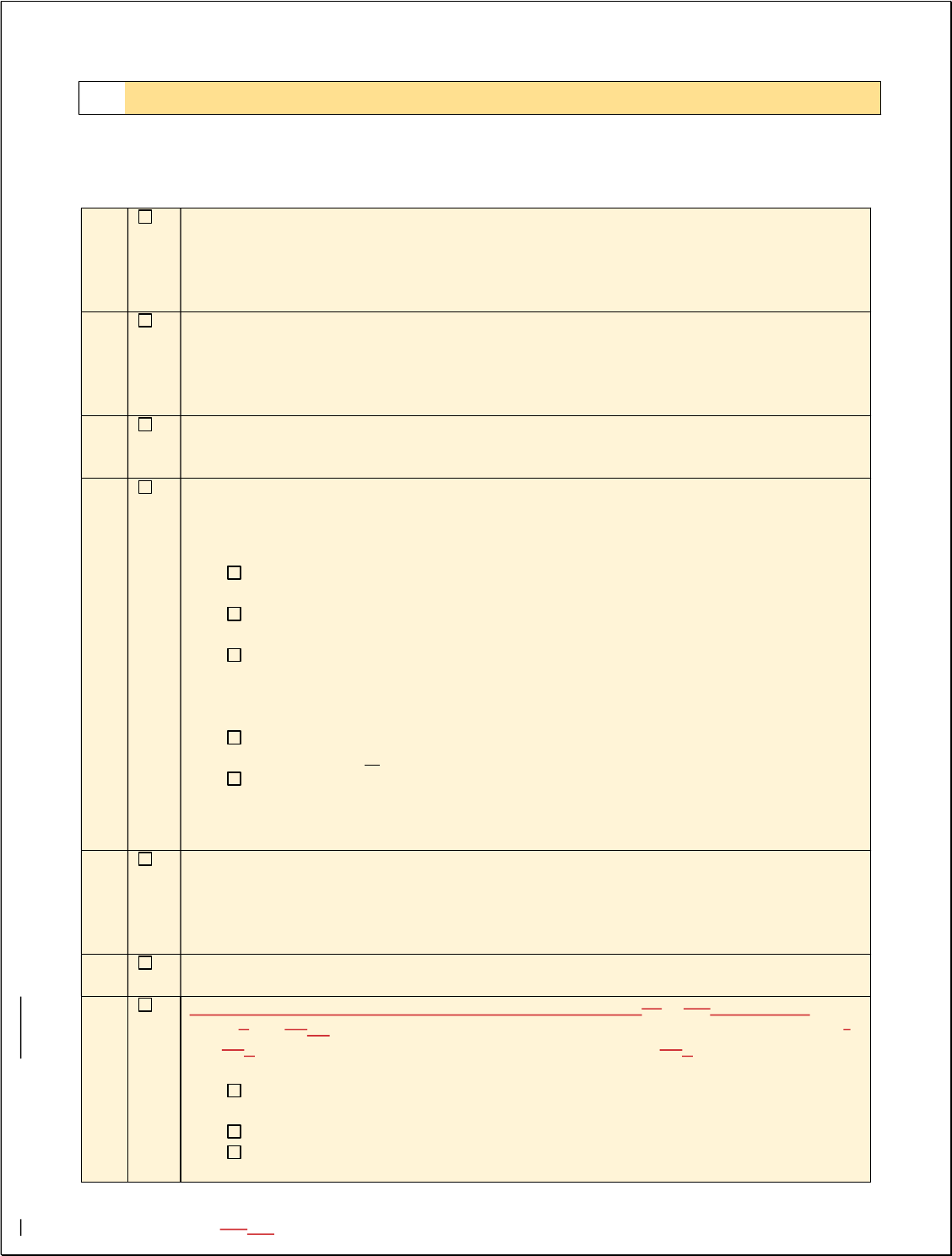

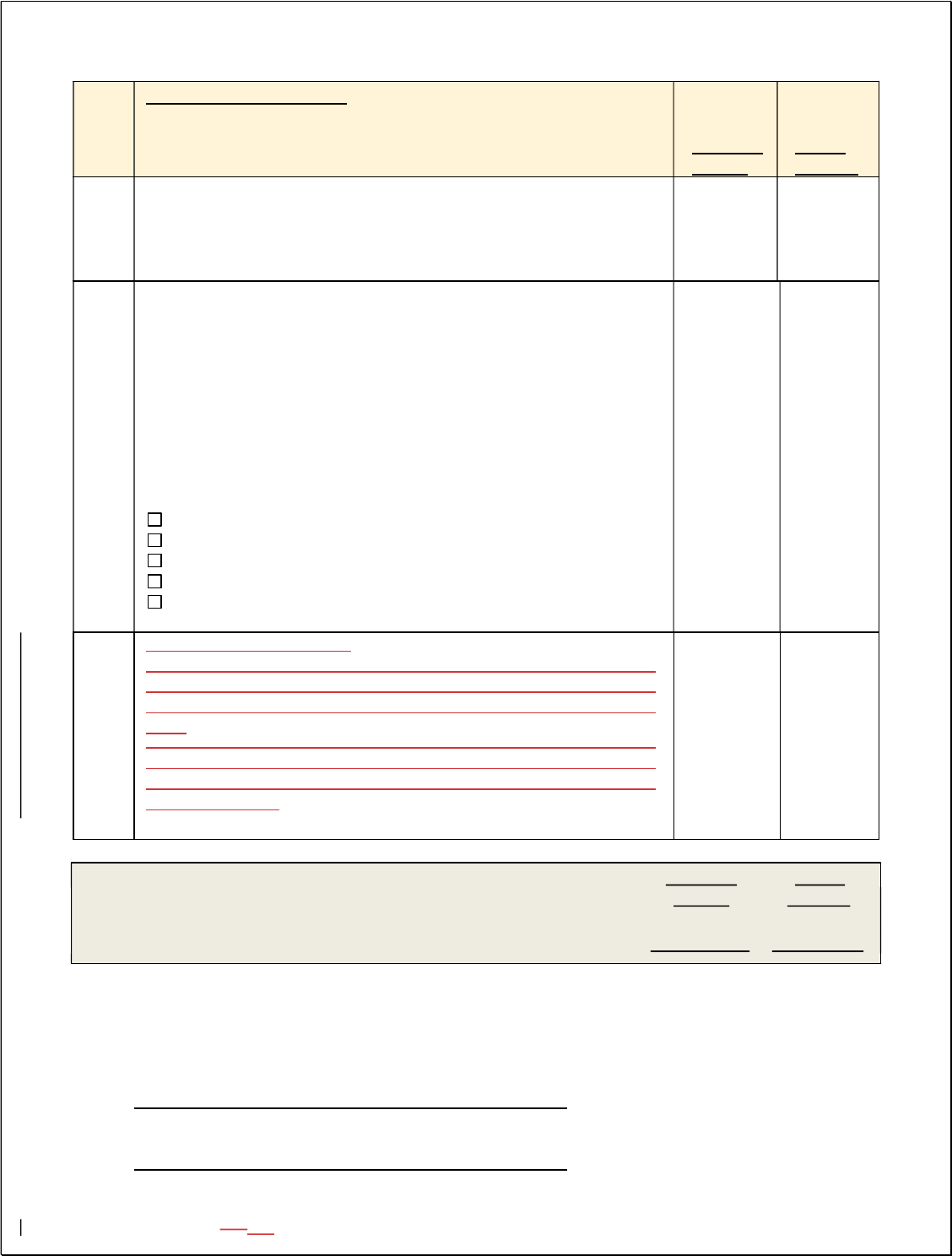

BIDDER BID BOND

Addenda 1& 2

Noted

BASE BID

Alternate #1: Apartment Passage

Hardware

Alternate #2: Passage Hardware in

remaining locations

Assured Security X X $218,424.12 $18,671.94 $5,130.20

Project: Access Control Replacement Project

Project Addresses: The Dakotah 900 S. Robert Street, West St Paul and Carmen Court 5825 Carmen Ave., Inver Grove Heights

Bid Opening: Friday, January 5, 2024: 10:00 a.m.

BID TABULATION

7B - Attachment B

20

Board of Commissioners

Request for Board Action

Meeting Date: February 28, 2024 Agenda #: 7C

DEPARTMENT: Community and Economic Development

FILE TYPE: Regular - Consent

TITLE

..title

Establish The Date For A Public Hearing On Qualified Allocation Plan For The Allocation Of

2025 Low Income Housing Tax Credits

..end

PURPOSE/ACTION REQUESTED

Set a public hearing to receive comments on the proposed Qualified Allocation Plan (QAP) for the

allocation of 2025 Low Income Housing Tax Credits

SUMMARY

In accordance with Section 42 of the Internal Revenue Code of 1986, as amended (“Code”), the

Dakota County Community Development Agency (CDA) as a suballocator of Low Income Housing

Tax Credits (“Tax Credits”) must set a public hearing date for the adoption of the 2025 QAP which

details the basis for allocating Tax Credits among applicants.

The CDA is a suballocator of Tax Credits, which are regulated under Section 42 of the Code. Under

the Code, the CDA must prepare a QAP setting forth the basis for allocating Tax Credits among

applicants and must hold a public hearing prior to adoption of the QAP. The purpose of this action is

to set the date of this public hearing for March 27, 2024.

A draft hearing notice to be published pursuant to board approval of this item is in Attachment A.

RECOMMENDATION

..recommendati on

Staff recommends to set the date of the public hearing to receive comments on the proposed QAP for

the allocation of 2025 Tax Credits for March 27, 2024.

..end

EXPLANATION OF FISCAL/FTE IMPACTS

N/A

☒ None ☐ Current budget ☐ Other ☐ Amendment Requested ☐ New FTE(s) requested

RESOLUTION

..body

WHEREAS, pursuant to Section 42 of the Internal Revenue Code of 1986, as amended (“Code”), and

Minnesota Statutes Sections 462A.221 through 462A.225, the Dakota County Community

Development Agency (CDA) is a housing credit agency authorized to allocate low income housing tax

credits (“Tax Credits”); and

WHEREAS, Section 42 of the Code, requires the CDA to hold a public hearing prior to adopting or

amending a Qualified Allocation Plan (QAP) detailing the basis for allocating Tax Credits among

applicants; and

21

Meeting Date: February 28, 2024 Agenda #: 7C

WHEREAS, the CDA proposes to adopt a QAP regarding the allocation of Tax Credits using 2025

volume cap and the allocation of any “automatic” tax credits attributable to private activity bonds

issued after the adoption of the plan (“2025 Plan”).

NOW, THEREFORE BE IT RESOLVED by the Dakota County Community Development Agency

Board of Commissioners, That:

1. A public hearing regarding the adoption of the 2025 Plan will be held by the CDA Board on

March 27, 2024 at or after 1:00 p.m. at the CDA’s office.

2. Staff are authorized and directed to cause notice of such public hearing to be published in a

newspaper of general circulation in the CDA’s jurisdiction not less than ten (10) days prior to

such hearing.

PREVIOUS BOARD ACTION

None.

ATTACHMENTS

Attachment A: Draft Public Hearing Notice

BOARD GOALS

☒ Focused Housing Programs ☐ Collaboration

☐ Development/Redevelopment ☐ Financial Sustainability ☐ Operational Effectiveness

CONTACT

Department Head: Lisa Alfson, Director of Community and Economic Development

Author: Kathy Kugel, Housing Finance Manager

22

NOTICE OF PUBLIC HEARING

NOTICE OF PUBLIC HEARING ON THE ADOPTION OF A QUALIFIED

ALLOCATION PLAN RELATING TO THE ALLOCATION OF LOW INCOME

HOUSING TAX CREDITS UNDER SECTION 42 OF THE INTERNAL REVENUE

CODE OF 1986, AS AMENDED

NOTICE IS HEREBY GIVEN that the Dakota County Community Development Agency (the

“Agency”) will meet on Wednesday, March 27, 2024, at or after 1:00 p.m. at its offices located at 1228

Town Centre Drive, Eagan, Minnesota 55123, for the purpose of conducting a public hearing regarding

the adoption of its 2025 Qualified Allocation Plan, which has been prepared in compliance with Section

42 of the Internal Revenue Code of 1986, as amended (“Code”). Section 42 of the Code authorizes

housing credit agencies such as the Agency to allocate low income housing tax credits (“Tax Credits”)

to owners of qualified residential rental projects. The 2025 Qualified Allocation Plan establishes

selection criteria to be used by the Agency in the allocation of Tax Credits in Dakota County.

Members of the public can participate in the public hearing in one of the following ways:

All persons interested may appear and be heard at the time and place set forth ab

ove.

The public may comment in writing or via voicemail. Any comments and materials submitted by

10:00 am of the day of the meeting will be attached to the public record and available for review

by the Board. Comments may be submitted to the Clerk of the Board via email at

[email protected] or by voicemail at 651-675-4434

.

[

Date of Publication]

BY ORDER OF THE DAKOTA COUNTY

COMMUNITY DEVELOPMENT AGENCY

B

y /s/ Tony Schertler

Executive Director

7C - Attachment A

23

Board of Commissioners

Request for Board Action

Meeting Date: February 28, 2024 Agenda #: 7D

DEPARTMENT: Administration

FILE TYPE: Regular - Consent

TITLE

..title

Approval Of Amendments To Personnel Policy #295 – Flex Leave Donation

..end

PURPOSE/ACTION REQUESTED

Approve amendments to Personnel Policy #295 – Flex Leave Donation

SUMMARY

Periodically, staff review personnel policies to make amendments that comply with best practices in

human resources.

Policy #295 – Flex Leave Donation has been updated to clarify uses of donated flex leave and

donation procedures. This policy was first adopted in 2018.

An edited version of the policy is Attachment A. A clean copy of the updated policy is Attachment B.

RECOMMENDATION

..recommendati on

Staff recommends approval of the updated policy.

..end

EXPLANATION OF FISCAL/FTE IMPACTS

N/A

☒ None ☐ Current budget ☐ Other ☐ Amendment Requested ☐ New FTE(s) requested

RESOLUTION

..body

WHEREAS, the Dakota County CDA’s Administration Department regularly reviews policies and

procedures and makes recommendations in order to comply with Federal, State and local laws and

best practices in human resources; and

WHEREAS, updates have been made to Policy #295 – Flex Leave Donation.

NOW, THEREFORE BE IT RESOLVED by the Dakota County Community Development Agency

Board of Commissioners, That the amendments to Personnel Policy #295 – Flex Leave Donation is

hereby approved.

BE IT FURTHER RESOLVED, the Human Resources Manager is authorized to implement the

policies and communicate the changes to CDA staff.

PREVIOUS BOARD ACTION

18-6051; 9/18/2018

24

Meeting Date: February 28, 2024 Agenda #: 7D

ATTACHMENTS

Attachment A: Amended policy – edited copy

Attachment B: Amended policy – clean copy

BOARD GOALS

☐ Focused Housing Programs ☐ Collaboration

☐ Development/Redevelopment ☐ Financial Sustainability ☒ Operational Effectiveness

CONTACT

Department Head: Sara Swenson, Director of Administration and Communications

Author: Sara Swenson

25

FLEX LEAVE DONATION #295

CDA Policy & Procedures Manual Page 1 of 3

The purpose of the flex leave donation program is to allow employees to transfer flex leave hours to

another employee to use for a serious illness or injury experiencing an emergency. This policy is not

intended to cover an employee who is experiencing a normal pregnancy, has a common illness or injury,

or as a substitute for short-term or long-term disability coverage. This transfer occurs only upon the

approval of Human Resources.

The Flex Leave Donation Program serves as a short-term solution up to a maximum of six monthsfour (4)

weeks in a calendar year, ,

allowing employees to receive paid leave in circumstances noted below:

Employee is unable to work because of own a serious illness or injury.

Employee is required to provide care for a seriously ill or injured parent, spouse, dependent

child, or household member.

In need of additional time off for bereavement in the event of death of a parent, spouse, child

or

household member.

This p

rogram runs concurrently with leave under Family Medical Leave Act (FMLA) or other unpaid

leaves, which employees are entitled to under federal or state law or as otherwise required by the CDA.

All required documentation must be submitted to Human Resources prior to a flex leave donation request.

The ma

ximum six-month time period will begin the first day the employee uses donated flex leave

hours and ends six calendar months later.

Recipient Eligibility:

An employee may apply for the Program if s/he meets an established set of criteria. The

employee must:

To be eligible to receive donated flex leave, an employee must:

1.

Have been a full-time employee of the Dakota County CDA for at least twelve six months or

a

part-time employee for at least twenty-four twelve months.

2.

Be eligible to accrue and use flex leave benefits.

3.

Be scheduled to Eexhaust all paid leave options. or be reasonably close to exhausting such pai

d

leave.

3.

4.

Has not been disciplined for any violations of the CDA’s policie

s.

4.5. Is on an ap

proved leave of absence relating to a medical emergency or bereavement.For an

employee requesting flex leave donation due to his/her own medical condition, he/she must be

approved for a leave of absence under the CDA’s Family Medical Leave (FMLA) policy or

Americans with Disabilities Act (ADA) policy. For an employee requesting flex leave donation to

care for a seriously ill or injured spouse, dependent child or household member, he/she must

obtain and submit medical documentation which verifies that a serious illness or injury

necessitates absence from work for a minimum of five days. This qualifying period does not have

to be consecutive.

5.6. Ha

s exhausted all other available paid time off including, but not limited to, flex leave, workers’

compensation and An employeenot be receiving or expecting to receive worker’s compensation,

or short-term or long-term disability benefits except that flex leave donations can assist with the

waiting period for short-term disability. is not eligible to receive donated time.

7. Ex

pect to return resume to employment with the CDA after the leave of absence ends.

7D - Attachment A

26

FLEX LEAVE DONATION #295

CDA Policy & Procedures Manual Page 2 of 3

Note: Leave eligibility will follow Minnesota State Law when applicable.

Procedures and Rules for Requesting Flex Leave Donation:

1. Employees, or a supervisor on behalf of the employee, may request flex leave donation through

Human Resources.

2. Completed FMLA paperwork or a Medical Leave Request form must be submitted to Human

Resources before the flex leave donation request will be approved. The forms must include the

nature of the illness or injury and the expected date the employee will return to work.

3.2. Human Resources will evaluate the flex leave donation request to determine recipient’s eligibility.

4.3. The recipient must sign a form agreeing to accept the donated hours.

4. The recipient will be responsible for all applicable taxes on the dollar value paid for the donated

hours.

5. The donor must submit a written and signed request of the CDA’s approved forms.

6. When a transfer has been finalized in accordance with these rules and approved by Human

Resources, the Finance Department will finalize the transfer of the flex leave hours.

7. Flex leave must be donated in increments of one (1) hour.

Flex leave donations are irrevocable; donated flex leave will not be returned to the employee who

donated it. For employment tax and wage-based benefit purposes, donated Flex Leave is considered

wages of the recipient and not the donor.

Flex leave donations shall be on a dollar-for-dollar basis. The worth of the flex leave shall be adjusted to

the pay level of the donor. Therefore, if the salary of the donor is greater than the recipient, one day of

flex leave of the donor shall result in more than one full day to the recipient. Conversely, if the salary of

the donor is less than the recipient, the one day of flex leave of the donor shall result in less than one full

day to the recipient.

Data Practices Notice to Employees:

An employee who seeks flex leave donation has the responsibility to provide reasonable medical

documentation to show the need for flex leave donation. Compliance is voluntary; however, failure to

provide the required information will result in a denial of the request. All information relating to the flex

leave donation, including medical documentation, shall be maintained in a separate file and shall be

treated as confidential medical records with access limited to those who need to be informed including,

but not limited to, Directors/Supervisors, Human Resources, and CDA legal counsel. If the flex leave

donation is approved, the all-staff request for donated flex leave hours will be sent. It is at the discretion of

the employee to disclose their name and/or the reason for their request in the all-staff communication. If

no one donates flex leave upon request, the requesting employee is not entitled to receive flex leave.

state the employee’s name and department. If the employee chooses, they may authorize Human

Resources to state the nature of the illness or injury in the request. Employees may also request that the

flex leave donation request is sent only to that employee’s department.

Procedures for Donating Flex Leave Hours:

Employees may transfer their flex leave hours to another employee under the following conditions:

27

FLEX LEAVE DONATION #295

CDA Policy & Procedures Manual Page 3 of 3

1. Such transfers can be made only after the showing of unique or special circumstances and only

upon approval of Human Resources.

2. Before such transfer will be approved the proposed recipient of the transfer must have used all of

his/her accrued or usable flex leave and all of his/her compensatory time.

3. Such transfer shall be on a dollar-for-dollar basis. The worth of the flex leave shall be adjusted to

the pay level of the donor. Therefore, if the salary of the donor is greater than the donee, one day

of flex leave of the donor shall result in more than one full day to the donee. Conversely, if the

salary of the donor is less than the donee, the one day of flex leave of the donor shall result in

less than one full day to the donee.

4. The minimum donation from a donor is (1) hour of flex leave and the maximum donation is (16)

hours of flex leave.

5. Requests for such transfer of flex leave must be submitted to Human Resources, in writing, by

the recipient employee or by the recipient employee's supervisor with the consent of the recipient

employee.

6. When such a request is received, Human Resources may, if s/he approves such a request, give

notice to CDA employees of the request for donation.

7. When a donor volunteers such transfer, they must sign a release document for transfer and the

document will be kept in the employee’s personnel file.

8. When a transfer has been finalized in accordance with these rules and approved by Human

Resources, they will notify the Finance Department and the necessary accounting action shall be

taken to reflect such transfer.

28

FLEX LEAVE DONATION #295

CDA Policy & Procedures Manual Page 1 of 2

The purpose of the flex leave donation program is to allow employees to transfer flex leave hours to

another employee experiencing an emergency. This policy is not a substitute for short-term or long-term

disability coverage. This transfer occurs only upon the approval of Human Resources.

The Flex Leave Donation Program serves as a short-term solution up to a maximum of four (4) weeks in a

calendar year, in circumstances noted below:

Employee is unable to work because of own serious illness or inju

ry.

Employee is required to provide care for a seriously ill or injured parent, spouse, dependent

child, or household member

.

In need of additional time off for bereavement in the event of death of a parent, spouse, child

or

h

ousehold member

.

This p

rogram runs concurrently with leave under Family Medical Leave Act (FMLA) or other unpaid

leaves, which employees are entitled to under federal or state law or as otherwise required by the CDA.

All required documentation must be submitted to Human Resources prior to a flex leave donation request.

Recipient Eligibility:

To be eligible to receive donated flex leave, an employee must:

1.

Have been a full-time employee of the CDA for at least six months or a part-time

employee for at

least twel

ve months.

2.

Be eligible to accrue and use flex leave benefits.

3.

Be scheduled to exhaust all paid leave op

tions.

4.

Has not been disciplined for any violations of the CDA’s policie

s.

5.

Is on an approved leave of absence relating to a medical emergency or bereavem

ent.

6.

Has exhausted all other available paid time off including, but not limited to, flex leave, worker

s’

comp

ensation and not be receiving or expecting to receive worker’s compensation, short-te

rm or

long-te

rm disability benefits except that flex leave donations can assist with the waiting period

for

short-term disability.

7.

Expect to resume employment with the CDA after the leave of absence ends

.

Procedur

es and Rules for Requesting Flex Leave Donation:

1.

Employees, or a supervisor on behalf of the employee, may request flex leave donation throug

h

Huma

n Resource

s.

2.

Human Resources will evaluate the flex leave donation request to determine recipient’s eligibil

ity.

3.

The recipient must sign a form agreeing to accept the donated hours.

4.

The recipient will be responsible for all applicable taxes on the dollar value paid fo

r the donated

hours.

5.

The donor must submit a written and signed request of the CDA’s

approved forms.

6.

When a transfer has been finalized in accordance with these rules and approved by Hu

man

Re

sources, the Finance Department will finalize the transfer of the flex leave ho

urs.

7.

Flex leave must be donated in increments of one (1

) hour.

7D - Attachment B

29

FLEX LEAVE DONATION #295

CDA Policy & Procedures Manual Page 2 of 2

Flex leave donations are irrevocable; donated flex leave will not be returned to the employee who

donated it. For employment tax and wage-based benefit purposes, donated Flex Leave is considered

wages of the recipient and not the donor.

Flex leave donations shall be on a dollar-for-dollar basis. The worth of the flex leave shall be adjusted to

the pay level of the donor. Therefore, if the salary of the donor is greater than the recipient, one day of

flex leave of the donor shall result in more than one full day to the recipient. Conversely, if the salary of

the donor is less than the recipient, the one day of flex leave of the donor shall result in less than one full

day to the recipient.

Data Practices Notice to Employees:

An employee who seeks flex leave donation has the responsibility to provide reasonable medical

documentation to show the need for flex leave donation. Compliance is voluntary; however, failure to

provide the required information will result in a denial of the request. All information relating to the flex

leave donation, including medical documentation, shall be maintained in a separate file and shall be

treated as confidential medical records with access limited to those who need to be informed including,

but not limited to, Directors/Supervisors, Human Resources, and CDA legal counsel. If the flex leave

donation is approved, the request for donated flex leave hours will be sent. It is at the discretion of the

employee to disclose their name and/or the reason for their request in the all-staff communication. If no

one donates flex leave upon request, the requesting employee is not entitled to receive flex leave.

30

Board of Commissioners

Request for Board Action

Meeting Date: February 28, 2024 Agenda #: 8A

DEPARTMENT: Housing Development

FILE TYPE: Regular - Action

TITLE

..title

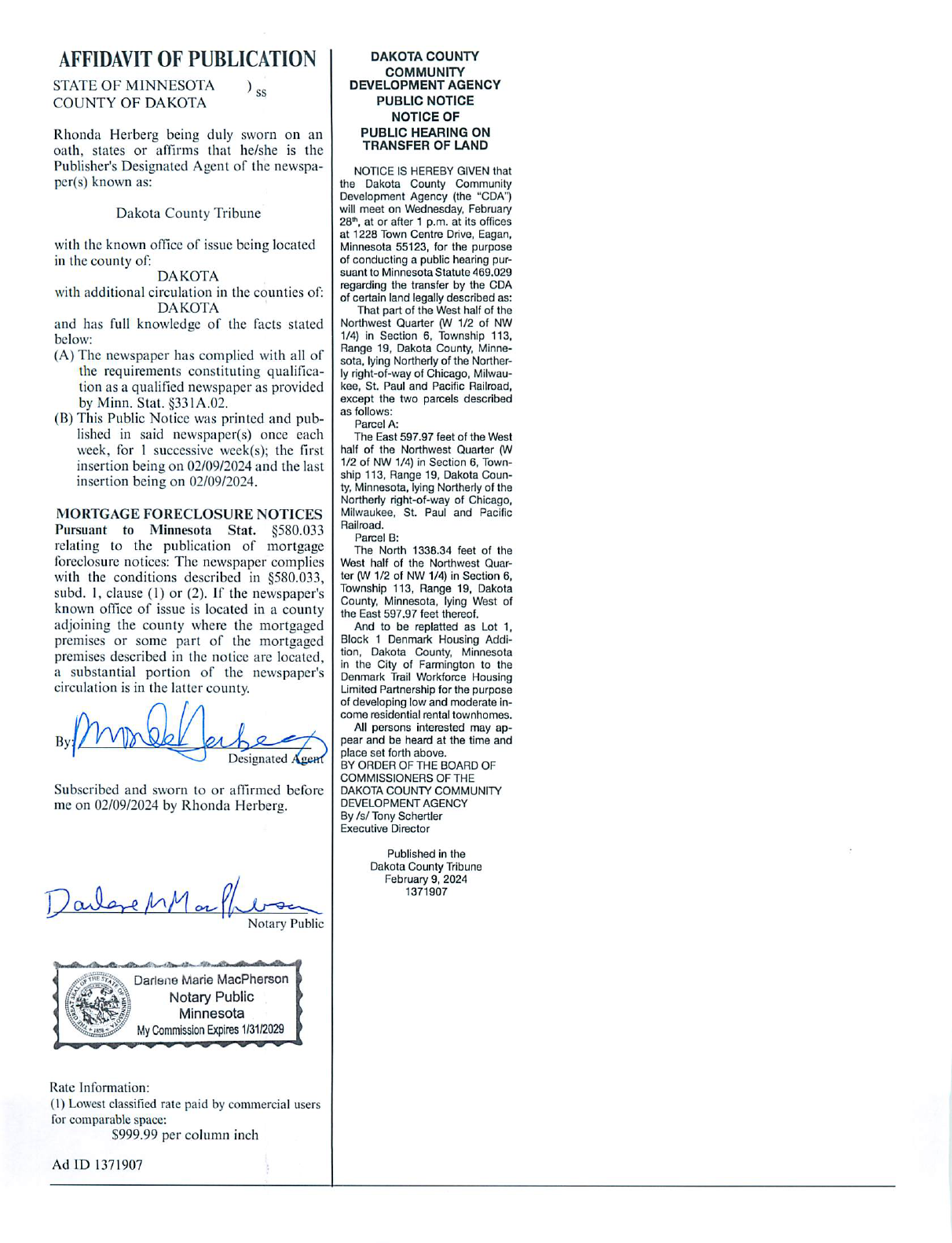

Public Hearing To Receive Comments And Approve Conveyance Of Land To The Denmark

Trail Workforce Housing Limited Partnership (Denmark Trail Townhomes, Farmington)

..end

PURPOSE/ACTION REQUESTED

Hold a public hearing to consider the conveyance of land in Farmington to the Denmark Trail

Workforce Housing Limited Partnership for the development of Denmark Trail Townhomes.

Approve the conveyance of the land.

SUMMARY

The CDA is considering the conveyance of property located in Farmington to Denmark Trail

Workforce Housing Limited Partnership for the development of affordable housing.

The Dakota County CDA, as General Partner of the Denmark Trail Workforce Housing Limited

Partnership, has applied for and received an allocation of 2034 and 2024 Low Income Housing Tax

Credits to develop Denmark Trail Townhomes, a 40-unit affordable workforce townhome

development in Farmington. Construction is expected to begin late spring 2024.

Minnesota Statute 469.029 requires a public hearing be held prior to the sale of real property by the

CDA. Notice of the public hearing was published in the Dakota County Tribune on February 9

(Attachment A).

RECOMMENDATION

..recommendati on

CDA staff recommends the conveyance of the property to the Denmark Trail Workforce Housing

Limited Partnership for the advancement of the Denmark Trail workforce housing development.

..end

EXPLANATION OF FISCAL/FTE IMPACTS

N/A

☒ None ☐ Current budget ☐ Other ☐ Amendment Requested ☐ New FTE(s) requested

RESOLUTION

..body

WHEREAS, the Dakota County Community Development Agency (CDA), pursuant to Minnesota

Statutes, Sections 469.001 through 469.047, is authorized to exercise its powers to undertake

housing development projects to provide for the construction of housing for low- and moderate-

income persons and their families; and

WHEREAS, the CDA desires to promote the development by the Denmark Trail Workforce Housing

Limited Partnership, of which the CDA is the sole general partner (the “Partnership”) of a housing

31

Meeting Date: February 28, 2024 Agenda #: 8A

development project comprised of a 40-unit townhome project housing which has received an

allocation of 2023 and 2024 low income housing tax credits; and

WHEREAS, the CDA has purchased and made certain capital expenditures with respect to the real

property legally described as follows: That part of the West half of the Northwest Quarter (W 1/2 of

NW 1/4) in Section 6, Township 113, Range 19, Dakota County, Minnesota, lying Northerly of the

Northerly right-of-way of Chicago, Milwaukee, St. Paul and Pacific Railroad, except the two parcels

described as follows: Parcel A: The East 597.97 feet of the West half of the Northwest Quarter (W

1/2 of NW 1/4) in Section 6, Township 113, Range 19, Dakota County, Minnesota, lying Northerly of

the Northerly right-of-way of Chicago, Milwaukee, St. Paul and Pacific Railroad. Parcel B: The North

1338.34 feet of the West half of the Northwest Quarter (W 1/2 of NW 1/4) in Section 6, Township 113,

Range 19, Dakota County, Minnesota, lying West of the East 597.97 feet thereof and to be re-platted

as Lot 1, Block 1 Denmark Housing Addition in the city of Farmington (the “Land”), which the CDA

proposes to contribute to the Partnership as the CDA’s capital contribution; and

WHEREAS, in accordance with the provisions of Minnesota Statutes, Section 469.029, Subdivision 2,

on the date hereof, following publication of notice, the CDA held a public hearing regarding the

conveyance of the Land to the Partnership; and

WHEREAS, the CDA has determined that it is in the best interest of the public health, safety, and

welfare that it convey the Land to the Partnership as the CDA’s capital contribution to the Partnership.

NOW, THEREFORE BE IT RESOLVED by the Dakota County Community Development Agency

Board of Commissioners, as follows:

1. The conveyance of the Land to the Partnership is hereby approved.

2. The Executive Director of the CDA is hereby authorized and directed to execute such

documents and take such actions as are necessary or convenient to convey the Land to the

Partnership.

PREVIOUS BOARD ACTION

24-6791; 1/24/2024

ATTACHMENTS

Attachment A: Affidavit of Publication

BOARD GOALS

☐ Focused Housing Programs ☐ Collaboration

☒ Development/Redevelopment ☐ Financial Sustainability ☐ Operational Effectiveness

CONTACT

Department Head: Kari Gill, Deputy Executive Director

Author: Lori Zierden, Real Estate Manager

32

8A - Attachment A

33

Board of Commissioners

Request for Board Action

Meeting Date: February 28, 2024 Agenda #: 8B

DEPARTMENT: Community and Economic Development

FILE TYPE: Regular - Action

TITLE

..title

Approval Of Contingent HOME American Rescue Plan Award To 360 Communities Lewis

House Shelter (Eagan)

..end

PURPOSE/ACTION REQUESTED

Approve contingent award of HOME American Rescue Plan (HOME-ARP) funds for the 360

Communities Lewis House Shelter in Eagan.

Authorize the execution of related documents.

SUMMARY

On March 11, 2021, President Biden signed the American Rescue Plan (ARP) into law that provided

over $1.9 trillion in relief to address the continued impact of the COVID-19 pandemic on the economy,

public health, state and local governments, and businesses.

To address the need for homelessness assistance and supportive services, Congress appropriated

$5 billion in ARP funds to be administered through the HOME Investment Partnerships Program

(HOME) to perform four activities that must primarily benefit qualifying individuals and families who

are homeless, at risk of homelessness, or in other vulnerable populations. Activities include

development of affordable rental housing; tenant-based rental assistance; provision of supportive

services; and acquisition and development of non-congregate shelter units.

The HOME Consortium (consisting of Anoka, Dakota, Ramsey, and Washington counties and the

City of Woodbury) received $8,762,441 in HOME-ARP funds; Dakota County’s portion is $3,232,623.

HOME-ARP funds required community engagement and development of a plan on proposed uses of

funds within the county. The HOME-ARP plan was approved by the Dakota County Board of

Commissioners on May 24, 2022 (Resolution No. 22-219), and by HUD on November 23, 2022. The

HOME-ARP plan identified two activities 1) support for a non-congregate shelter, with a domestic

violence preference, and 2) development and support of affordable housing. HOME-ARP funds need

to be expended by September 30, 2030.

The CDA issued a Request For Proposal (RFP) on November 14, 2023 and received one response

before the January 19, 2024 deadline from 360 Communities. 360 Communities is a non-profit and

operates the only domestic and sexual violence shelter in Dakota County. The non-profit proposed a

$14.6 million non-congregate shelter that increases capacity from 23 beds to 50 beds, with every unit

having full kitchens and bathrooms. CDA staff reviewed and scored the application, in addition to

conducting a meeting with 360 Communities leadership staff on February 14, 2024.

RECOMMENDATION

..recommendati on

Staff recommends the Board authorize a $3,000,000 HOME-ARP grant for the construction of a non-

congregant shelter contingent upon the completion of an environmental review, securing all

34

Meeting Date: February 28, 2024 Agenda #: 8B

necessary funding to complete the project, and finalizing grant agreement terms. Additionally, staff

recommends the Board authorize staff to prepare, execute, and deliver all documents necessary to

provide for the commitment of HOME-ARP funds, and authorize the Executive Director to execute

and deliver all related documents.

..end

EXPLANATION OF FISCAL/FTE IMPACTS

Dakota County’s portion of the HOME-ARP Program funds is $3,232,623, with $3,000,000 available

for eligible activities, and the remainder for administrative expenses on behalf of the HOME

Consortium

☐ None ☒ Current budget ☐ Other ☐ Amendment Requested ☐ New FTE(s)

requested

RESOLUTION

..body

WHEREAS, the counties of Anoka, Dakota, Ramsey, and Washington and the City of Woodbury

(referred to together as the “HOME Consortium”) created a consortium under the Title I of the

Cranston-Gonzalez National Affordable Housing Act (Act) for purposes of acting as a participating

jurisdiction under the Act and HOME Investment Partnerships Program Final Rule 24 CFR Part 92

which as amended sets forth regulations governing the applicability and use of funds under Title II

(HOME Program); and

WHEREAS, Dakota County is designated as the Lead Agency for the HOME Consortium and is

responsible for certain administrative and reporting functions of the HOME Program as required by

the U.S. Department of Housing and Urban Development (HUD); and

WHEREAS, Dakota County enters into a subrecipient agreement annually with the Dakota County

Community Development Agency (CDA) to administer the HUD entitlement programs, including

HOME, and has delegated to the CDA the rights, duties and obligations to disburse, monitor and

administer HUD entitlement funds, in a manner consistent with the terms and conditions imposed on

the CDA by said agreement, Dakota County resolution, and HUD and programmatic regulations; and

WHEREAS, the American Rescue Plan (ARP) Act of 2021 was signed into law on March 11, 2021,

and appropriated $5 billion in ARP funds to be administered through the HOME Program at the local

level to respond to the COVID-19 pandemic; and

WHEREAS, the HOME Consortium HOME-ARP allocation is $8,762,411, and the Dakota County

portion is $3,253,282; and

WHEREAS, the HOME-ARP funds can only be used for four activities: acquisition and development

of non-congregate shelter units, development and support of affordable housing, tenant-based rental

assistance, and provision of supportive services; and

WHEREAS, the HOME-ARP activities must primarily benefit four qualifying populations, including

individuals and families who are homeless; at risk of homelessness; fleeing or attempting to flee

domestic violence, dating violence, sexual assault, stalking, or human trafficking; and other

vulnerable populations, including individuals and families with incomes at or below 30 percent Area

Median Income; and

35

Meeting Date: February 28, 2024 Agenda #: 8B

WHEREAS, Dakota County entered into a funding approval agreement with HUD to execute and

implement the HOME-ARP Program in September 2021; and

WHEREAS, the Dakota County HOME-ARP plan was approved by the Dakota County Board of

Commissioners on May 24, 2022 (Resolution No. 22-219), and by HUD on November 23, 2022 with

two activities identified for use of HOME-ARP funds within Dakota County, 1) support for a non-

congregate shelter, with a domestic violence preference, and 2) development and support of

affordable housing; and

WHEREAS, on or before January 19, 2024, the CDA received one response to the HOME-ARP

Request For Proposals from 360 Communities requesting $3,000,000 HOME-ARP funds to assist

with the development of a non-congregate shelter for individuals and families fleeing or attempting to

flee domestic violence, dating violence, sexual assault, stalking, or human trafficking; and

WHEREAS, the 360 Communities application was reviewed, evaluated, and scored by staff and

included a meeting with leadership staff of 360 Communities to better understand the proposed

shelter; and

WHEREAS, CDA staff is supportive of the 360 Communities proposed shelter and recommends

awarding $3,000,000 of HOME-ARP funds to the project, contingent upon successful completion of

the environmental review, finalizing grant agreement terms, and securing necessary financing to

complete the project.

NOW, THEREFORE BE IT RESOLVED by the Dakota County Community Development Agency

Board of Commissioners, That

1. The CDA hereby approves an award of HOME-ARP Program funds in the amount of

$3,000,000 for the construction of the non-congregant Lewis House Shelter.

2. Staff is authorized to prepare, execute, and deliver all documentation necessary or convenient

to provide for the commitment of HOME-ARP Program funds based on findings made in

accordance with the requirements of the HOME-ARP Program. In addition, staff is authorized

to determine award contingencies for the project based on the characteristics of the

development, financial feasibility, project underwriting, or other factors in accordance with the

HOME-ARP Program.

3. Staff is authorized to prepare, execute, and deliver all documentation necessary or convenient

to provide for the commitment of the HOME-ARP Program funds.

4. The Executive Director of the Dakota County CDA is authorized to execute said documents

upon such release.

PREVIOUS BOARD ACTION

N/A

ATTACHMENTS

Attachment A: 360 Communities Application Narrative

BOARD GOALS

☒ Focused Housing Programs ☒ Collaboration

36

Meeting Date: February 28, 2024 Agenda #: 8B

☐ Development/Redevelopment ☐ Financial Sustainability ☐ Operational Effectiveness

CONTACT

Department Head: Lisa Alfson, Director of Community and Economic Development

Author: Lisa Alfson

37

8B - Attachment A

38

39

40

41

42

43

44

45

46

47

48

49

Board of Commissioners

Request for Board Action

Meeting Date: February 28, 2024 Agenda #: 8C

DEPARTMENT: Community and Economic Development

FILE TYPE: Regular - Informational

TITLE

..title

Discussion Of Proposed Housing Tax Credit Qualified Allocation Plan Revisions For The 2025

Low Income Housing Tax Credit Allocation

..end

PURPOSE/ACTION REQUESTED

Presentation on the drafted 2025 Qualified Allocation Plan for the allocation of Low-Income Housing

Tax Credits and discussion of changes.

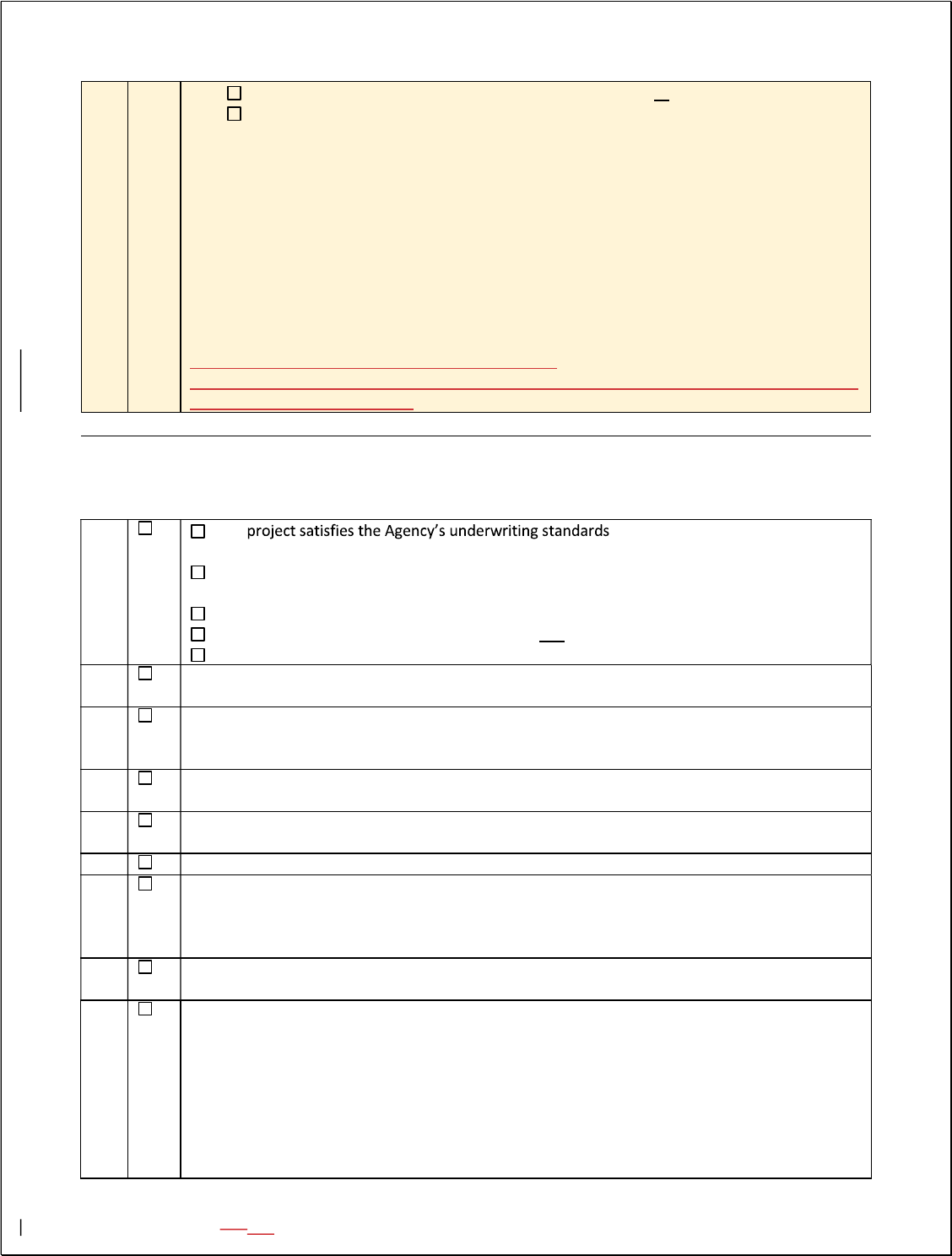

SUMMARY

The Dakota County Community Development Agency (CDA) is authorized under Section 42 of the

Internal Revenue Code of 1986, as amended (“Code”) and Minnesota Statutes Sections 462A.221

through 462A.225, to allocate Low Income Housing Tax Credits (“Tax Credits”) to qualified projects in

Dakota County. Prior to allocating Tax Credits under the Code, the CDA is required to adopt a

Qualified Allocation Plan (QAP) detailing the basis for allocating Tax Credits among applicants.

As required in the Code, the CDA allocates Tax Credits to housing projects in Dakota County

according to a QAP and Procedural Manual (“Manual”). The QAP and Manual establish the

procedure and selection criteria for a competitive application process for the 9% Tax Credits and for

4% Tax Credits that are allocated on a non-competitive basis to projects financed with tax exempt

bonds. The application deadline for the competitive 2025 9% Tax Credits is tentatively set for July 11,

2024.

The CDA is currently authorized to allocate an estimated $1,128,688 of 2025 Tax Credits, which

typically means a developer can build a 40-45-unit project. The annual allocations are based on the

distribution plan from Minnesota Housing, and a per capita volume cap determined each year by the

Internal Revenue Service. Since 1988, Tax Credits have been used to finance the new construction,

preservation and/or substantial rehabilitation of 3,927 units of affordable rental housing in 64

developments in Dakota County (Attachment A).

The QAP includes a Scoring Worksheet where applicants must meet several threshold requirements

and includes the ability to score points through other selection criteria. These thresholds and points

allow the CDA to target this affordable housing resource to encourage developments to provide

deeper and longer affordability, as well as adjusting for unit sizes or location.

A summary of the proposed 2025 QAP scoring is in Attachment B and the proposed revisions to the

2025 Self Scoring Worksheet are shown in Attachment C. In addition to formatting and administrative

revisions (including updating dates, credit amounts and clarifying text), the most substantive revisions

proposed to the QAP for 2025 include:

50

Meeting Date: February 28, 2024 Agenda #: 8C

a. Selection Criteria

Community Revitalization (a.13):

The ability to earn points for a project located in a Qualified Census Tract (QCT) and that is a part of

a community revitalization plan/Community Development Initiative has been included under our

Preference Priorities section for 5 points. Code requires this be a point category. Staff proposes to

remove this item from under the Preference Priorities section and merge it with Selection Criteria item

#13, Rehabilitation under Community Revitalization Plan.

The proposed change to #13 removes the requirement #13 be only for rehabilitation of an existing

project, adds a clear definition of what a community revitalization plan means (now referred to as a

Community Development Initiative) and includes the QCT Code requirement. The revised #13 is

similar to how Minnesota Housing includes this Code preference requirement regarding a project

located in a QCT which contributes to a concerted community revitalization plan.

Staff proposes this combined #13 continue to be worth 5 points but will remove the 5 points under the

Preference Priority category. Minnesota Housing has this item worth 3 points and Washington County

has it is worth 1 point.

b. Preference Priorities

Geographic Balance (b.3):

As stated in the CDA Housing Finance Policy, it is the CDA’s policy to encourage the distribution of

affordable housing throughout the county in order to avoid concentration of such housing in any one

city or section of a city. To assist with this distribution of affordable rental housing throughout the

county staff proposes to add an item under the Preference Priorities section providing points to

projects that are located in a city that has not received a 9% or 4% Tax Credit award for new

affordable housing development from the CDA or through Minnesota Housing in the prior 3 years.

Staff proposes awarding 5 points. Washington County awards 5 points to a similar item and

Minnesota Housing awards 4 points.

RECOMMENDATION

..recommendati on

Staff would like the Board’s input on the proposed changes to the QAP. After this meeting, the QAP

will be published for public comment and a public hearing will be held at the March 27, 2024 CDA

Board Meeting.

..end

EXPLANATION OF FISCAL/FTE IMPACTS

N/A

☒ None ☐ Current budget ☐ Other ☐ Amendment Requested ☐ New FTE(s) requested

ATTACHMENTS

Attachment A: Dakota County CDA 9% and 4% Tax Credit Award History

Attachment B: Draft 2025 QAP Scoring Summary

Attachment C: Draft 2025 QAP Scoring Worksheet with redlined changes

BOARD GOALS

☒ Focused Housing Programs ☐ Collaboration

☐ Development/Redevelopment ☐ Financial Sustainability ☐ Operational Effectiveness

51

Meeting Date: February 28, 2024 Agenda #: 8C

CONTACT

Department Head: Lisa Alfson, Director of Community and Economic Development

Author: Kathy Kugel, Housing Finance Manager

52

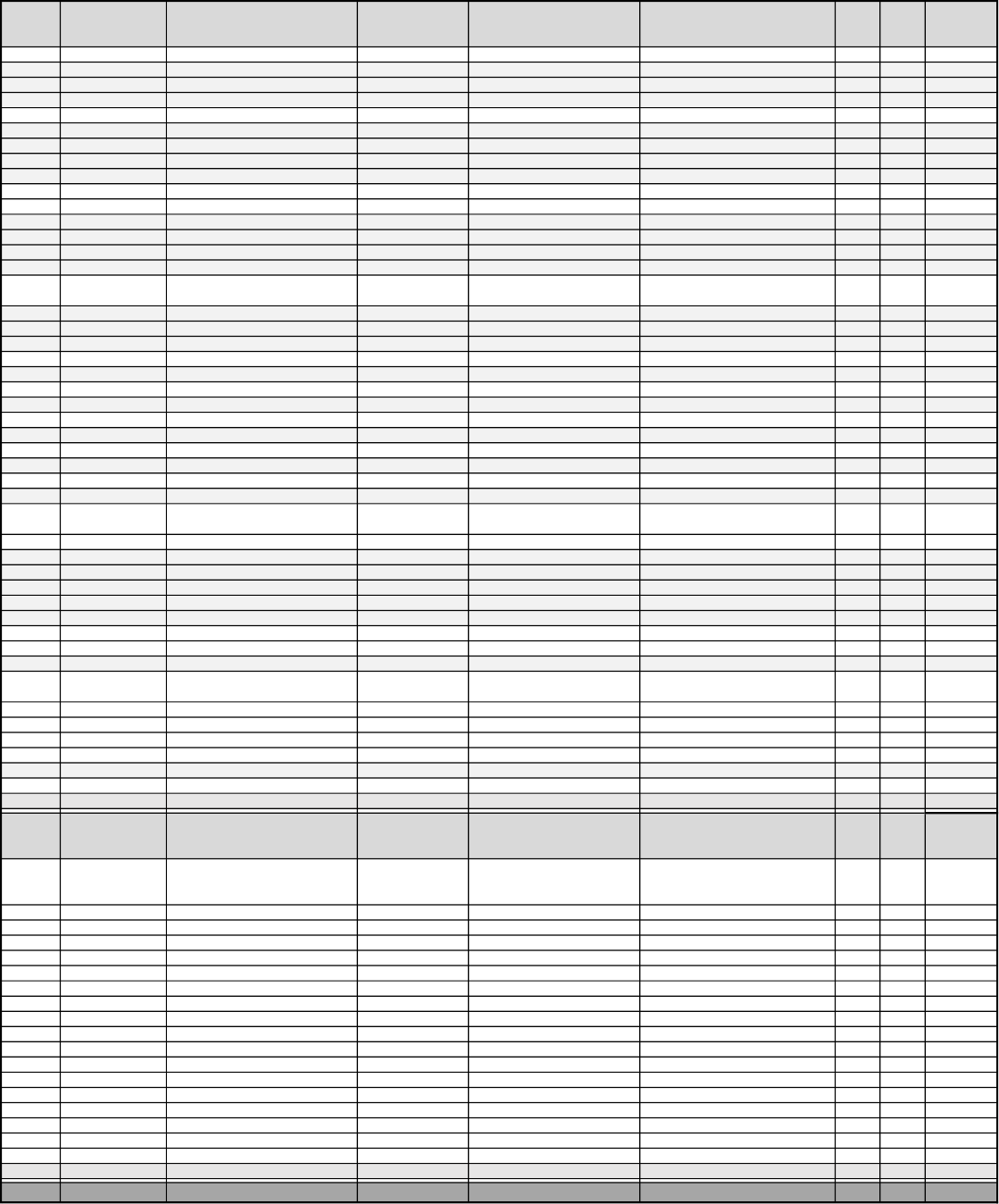

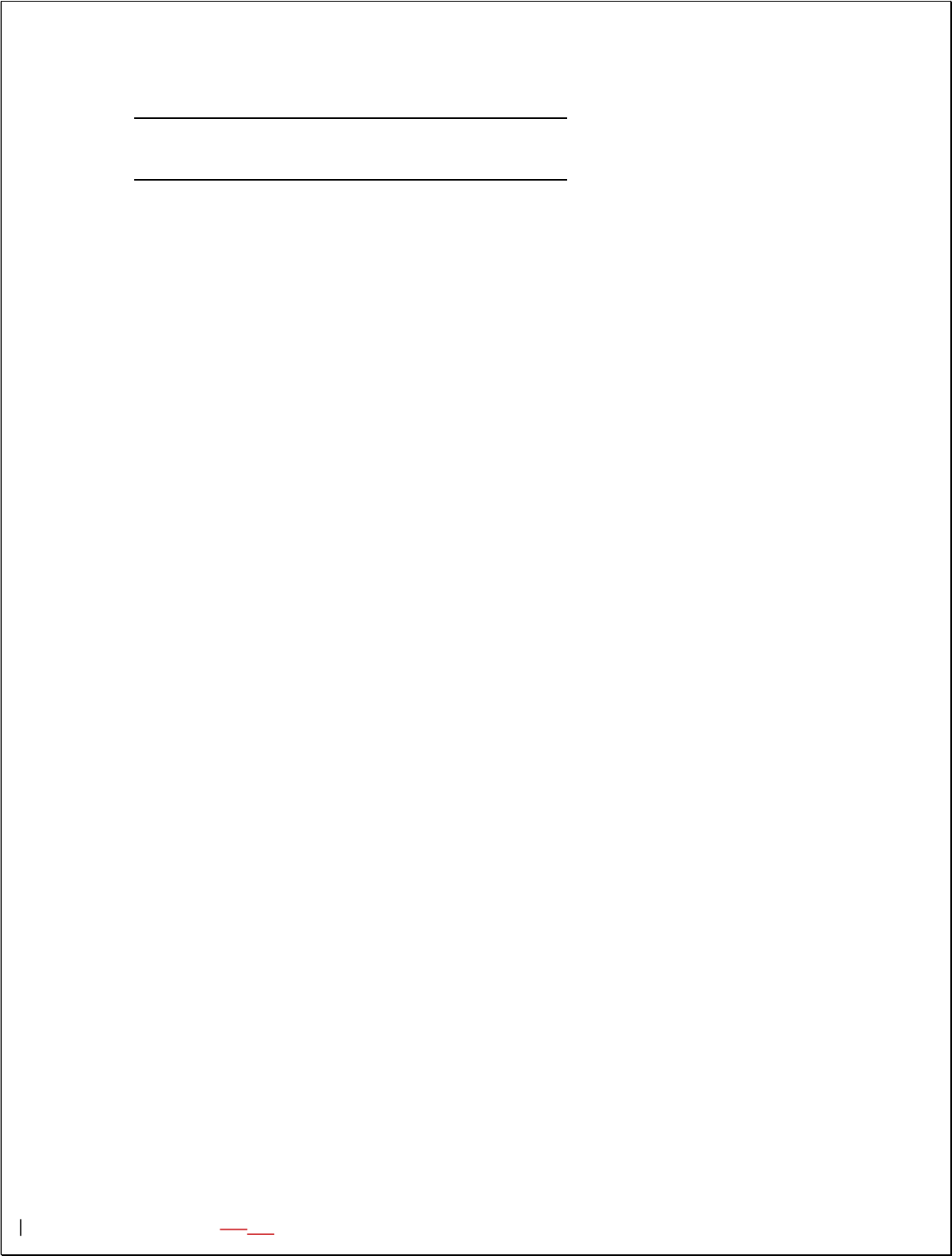

Dakota County 9% and 4% Housing Tax Credit Projects

Tax Credit

Type

Allocation Year

Project Name

City

Owner/Developer

Type

Tax

Credit

Units

Total

Units

Affordability

End Date

9% 1988 & 1989 Wescott Hills Eagan Wescott V LP New construction 16 16 2004

9% 1990 Parkside Townhomes Burnsville Dakota County CDA New construction 22 22 2027

9% 1991 & 1992 Glenbrook Place Townhomes Apple Valley Dakota County CDA New construction 39 39 2023

9% 1994 (MHFA) Spruce Pointe Townhomes Inver Grove Heights Dakota County CDA New construction 24 24 2024

9% 1994 Lakeville Court Apartments Lakeville Sand Companies New construction 50 52 2025

9% 1995 Oak Ridge Townhomes Eagan Dakota County CDA New construction 42 42 2025

9% 1996 Pleasant Ridge Townhomes Hastings Dakota County CDA New construction 31 31 2026

9% 1997 Cedar Valley Townhomes Lakeville Dakota County CDA New construction 30 30 2027

9% 1998 Chasewood Townhomes Apple Valley Dakota County CDA New construction 27 27 2028

9% 1998 & 1999 Farmington Townhomes Farmington Sherman Associates New construction 16 16 2029

9% 1999 & 2000 Farmington Family Townhomes Farmington Hornig Companies New construction 28 32 2031

9% 1999 & 2001 Country Lane Townhomes Lakeville Dakota County CDA New construction 29 29 2030

9% 2000 Hillside Gables Townhomes Mendota Heights Dakota County CDA New construction 24 24 2030

9% 2001 Hastings Marketplace Townhomes Hastings Dakota County CDA New construction 28 28 2031

9% 2002 Burnsville HOC Townhomes Burnsville Dakota County CDA New construction 34 34 2032

9% 2002 Clark Place Apts (fka Kaposia Terrace) South St. Paul

DRS Investment VII LLC (orig was

Real Estate Equities)

New construction 20 20 2032

9% 2003 Erin Place Townhomes Eagan Dakota County CDA New construction 34 34 2033

9% 2003 Prairie Crossing Townhomes Lakeville Dakota County CDA New construction 40 40 2034

9% 2004 LaFayette Townhomes Inver Grove Heights Dakota County CDA New construction 30 30 2035

9% 2004 Haralson Apartments Apple Valley CHDC New supportive & workforce 36 36 2035

9% 2005 & 2007 West Village Townhomes Hastings Dakota County CDA New construction 21 21 2036

9% 2006 Chowen Bend Townhomes Burnsville Chris Cooper (orig was Dominium) Preservation/Rehabilitation 32 32 2036

9% 2006 & 2008 Carbury Hills Townhomes Rosemount Dakota County CDA New construction 32 32 2037

9% 2007 Cliff Hills Townhomes Burnsville Shelter Corporation Preservation/Rehabilitation 32 32 2037

9% 2007 & 2008 Twin Ponds Townhomes Farmington Dakota County CDA New construction 25 25 2038

9% 2007 & 2008 Rosemount Greens Rosemount TCHDC Preservation/Rehabilitation 28 28 2036

9% 2008 & 2009 & 2010 Meadowlark Townhomes Lakeville Dakota County CDA New construction 40 40 2039

9% 2009 Chancellor Manor Burnsville CHDC Preservation/Rehabilitation 186 200 2039

9% 2010 Quarry View Townhomes Apple Valley Dakota County CDA New construction 45 45 2040

9%

1990 & 1991

& 2008

Kidder Park Townhomes

(fka Park Place)

Rosemount Boisclair Corporation

New construction/

2008 substantial rehab

36 36

2041

9% 1991 & 2011 Andrews Pointe Burnsville Shelter Corporation New construction/2011 rehab 57 57 2040

9% 2011 Twin Ponds (Phase II) Townhomes Farmington Dakota County CDA New construction 26 26 2041

9% 2012 Northwoods Townhomes Eagan Dakota County CDA New construction 47 47 2042

9% 2013 Inver Hills TH/ Riverview Ridge TH IGH & Eagan Dakota County CDA New construction 51 51 2043

9% 2014 & 2015 Lakeshore Townhomes Eagan Dakota County CDA New construction 50 50 2044

9% 2015 Keystone Crossing Townhomes Lakeville Dakota County CDA New construction 36 36 2045

9% 2016 Artspace Hastings Lofts Hastings Artspace New construction 37 37 2046

9% 2017 Lakeville Pointe Lakeville Ron Clark/Connelly Development New construction 49 49 2046

9% 2018 Prestwick Place Townhomes Rosemount Dakota County CDA New construction 40 40 2048

9%

2001 & 2002

and 2019

Guardian Angels Apartments

& Townhomes

Hastings

CommonBond

(2001 was Sherman Associates)

Substantial Rehab/Stabilization (2001

was new construction & rehabilitation)

33 33

2049

9% 2019 & 2020 Wexford Place Apartments Rosemount Ron Clark/Connelly Development New construction 49 49 2054

9% 2020 Prairie Estates Inver Grove Heights TCHDC Preservation/Rehab 40 40 2051

9% 2020 & 2021 Lexington Flats Eagan MWF Properties LLC New construction 50 50 2050

9% 2021 & 2022 Babcock Crossing Inver Grove Heights Ron Clark/Connelly Development New construction 49 49 2052

9% 2023 & 2024 Denmark Trail Townhomes Farmington Dakota County CDA New construction 40 40 TBD

9% 2024 Pillsbury Ridge Burnsville MWF Properties LLC New construction 48 48 TBD

Total 9% 46 Total 9% 1,779 1,799

Tax Credit

Type

Allocation Year

Project Name

City

Owner/Developer

Type

Tax

Credit

Units

Total

Units

Affordability

End Date

4% 2001

Clark Place Apts (fka Rose

Apartments/aka Kaposia Apartments)

South St. Paul

DRS Investment VII LLC (orig was

Real Estate Equities)

Acquisition/Rehab 48 48 2031

4% 2002 Grande Market Place Burnsville Sherman New Construction 53 113 2033

4% 2003 Hearthstone Apartments Apple Valley Stonebridge New Construction 50 228 2033

4% 2003 Blackberry Trail Apartments Inver Grove Heights Michael Development New Construction 88 219 2034

4% 2006 Spruce Place Apartments Farmington CommonBond Acquisition/Rehab 60 61 2035

4% 2008 Waterford Commons Rosemount Stonebridge New Construction 24 108 2038

4% 2015 The Sanctuary at WSP West St. Paul SCA Shelter New Construction 164 164 2046

4% 2016 Legends at Apple Valley Apple Valley Dominium New Construction 163 163 2047

4% 2017 Whitney Grove TH (fka Oaks of AV) Apple Valley CommonBond Acquisition/Rehab 55 56 2046

4% 2018 Winslow (fka DARTS) Senior West St. Paul Real Estate Equities New Construction 172 172 2049

4% 2020 Aster House Eagan Real Estate Equities New Construction 204 204 2051

4% 2021 The Quill Hastings Real Estate Equities New Construction 90 90 2051

4% 2021 Hilltop at Signal Hills West St. Paul Dominium New Construction 146 146 TBD

4% 2021 Legacy Commons at Signal Hills West St. Paul Dominium New Construction 247 247 TBD

4% 2022 The Villas at Pleasant Avenue Burnsville MWF Properties LLC New Construction 150 150 TBD

4% 2023 The Landing at Amber Fields Rosemount Real Estate Equities New Construction 160 160 TBD

4% 2022 The Villas at Pleasant Avenue II Burnsville MWF Properties LLC New Construction 110 110 TBD

4% 2023 Croft at Rosecott Rosemount Schafer Richardson New Construction 164 164 TBD