Get a FREE BPI eCredit for a secure online shopping experience!

Choose up to two cards and enjoy FREE membership on both for the first year.⁵ Your first Supplementary card is FREE for life.

1

Travel fare of the Cardholder must be charged to his/her BPI Credit Card.

2

BPI-accredited establishments.

3

Terms & conditions apply. Visit www.bpi.com.ph.

4

Terms and Conditions for Amore Cashback Program & Other Privileges apply. Visit bit.ly/bpiamoretc to learn more.

5

The Cardholder will receive the card variant he/she is qualified for, depending on the evaluation of his/her application.

Source of Funds

Principal cardholders for at least one year are no longer required to submit any proof of income.

If Source of Funds is Remittance, provide the following additional information:

Remitter Type

Individual Corporate

Remitter’s Name

(Salary, Business, Commission, Remittance, Pension, etc.)

Are you a BPI DEPOSITOR?

Yes

No

CARD NUMBER CREDIT LIMITBANK NAME

MY OTHER CREDIT CARDS (IF ANY):

1

st

Supplementary Cardholder

Extend the benefits of your card and get a supplementary card. You will be issued a supplementary card for your primary card choice.

(FREE for Life!)

Office/Business Phone Number/Local

Principal cardholders for at least one year are no longer required to submit any proof

of income, if they are able to provide the following:

- Bank name and credit card number

FOR EXISTING CREDIT CARDHOLDER (with other banks)

Any of the following income documents

may be accepted:

-

Certificate of Employment (COE)

-

Latest two (2) months Payslips

-

Latest Income Tax Return (ITR) with

BIR/ bank stamp

FOR EMPLOYED FOR SELF EMPLOYED

ACCEPTABLE INCOME DOCUMENTS:

Latest Audited Financial

Statements (AFS) with BIR/bank

stamp AND Latest Income Tax

Return (ITR) with BIR/ bank stamp

-

DOCUMENTS TO SUBMIT:

Completely filled-out and signed application form

1.

Proof of Income3.

2.

Photocopy of at least one (1) valid ID with photo

- Passport

- Company ID issued by private entity or institutions registered with

or supervised or regulated by the BSP, SEC or IC

- Professional Regulation Commission (PRC) ID

- Refer to the List of Acceptable Income Documents

- Voter’s ID

- BIR/TIN ID

- Driver’s License

- Postal ID

- SSS/GSIS ID

* Applicable for Beneficiary only.

** Applicable for OFW and Beneficiary.

ADDITIONAL REQUIREMENT (IF APPLICABLE):

Owners / Managers of Pawnshop, Forex dealers,

Money Changers & Remittance Agents - Certificate of Registration

issued by BSP

Insurance Agents - Insurance Commission License

Non-Filipino Resident - Alien Certificate of Registration (ACR),

work permit or Embassy Accreditation Papers

APPLICATION REQUIREMENTS

About Me

About My Work

About My Finances

My Supplementary Cardholders

Note: All supplementary applicants must submit a photocopy of one (1) valid ID with picture.

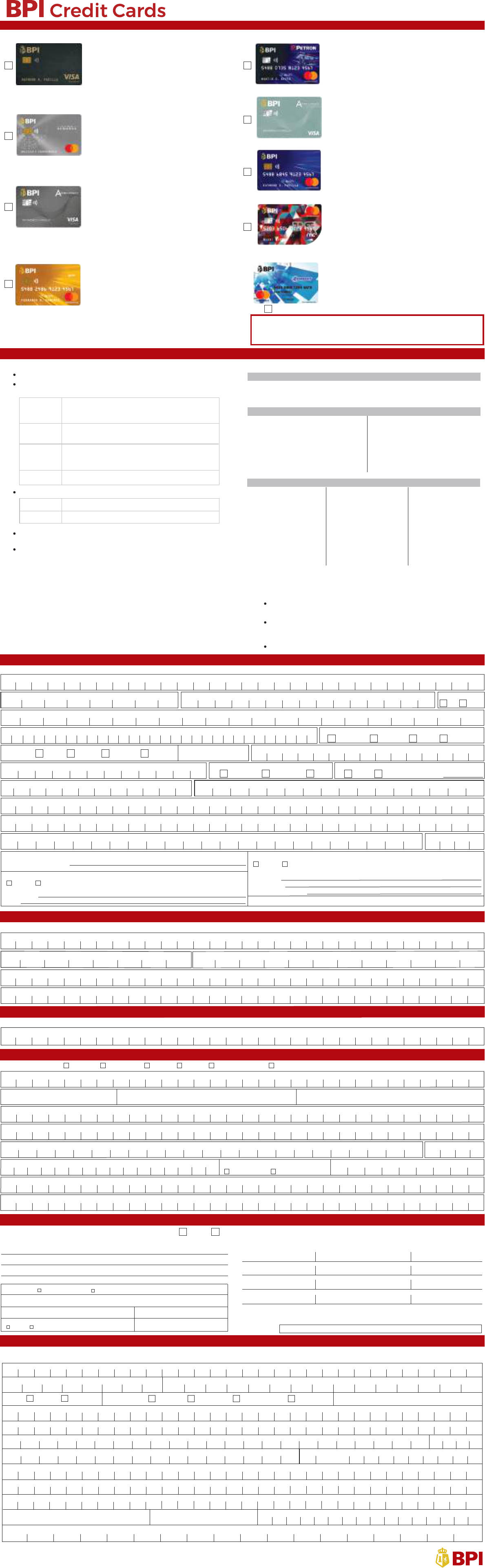

BPI Amore Platinum Cashback

The Global Cashback Card

• Earn cashback⁴ for every

₱

1,000 spend anywhere, both in-store

and online: 4% on restaurants, 1% on supermarkets, department stores,

& other shopping stores, 0.3% on everything else.

• Earn as much as

₱

15,000 in cashback every year

• Enjoy exclusive Ayala Malls privileges:

• Unlimited access to Ayala Malls’ Customer & Family Lounges

• 5% discount on your movie ticket purchase at Ayala Malls Cinemas

• Complimentary parking tickets valid at select Ayala Malls, your

welcome gift from us

BPI Gold Mastercard

The Premium Card

• Earn 1 BPI Point for every

₱

35 spend

• Travel insurance coverage of up to

₱

10 million¹

BPI Visa Signature

Your Travel and Lifestyle Card with Our Signature

Rewards

• Earn 2 BPI Points for every

₱

20 spend

BPI Platinum Rewards Mastercard

The Most Affordable Way to Fly

• Earn 2 BPI Points for every

₱

30 local spend

• Earn 2 BPI Points for every

₱

20 spend on any foreign transaction online

and abroad

• Real 0% Installment up to 6 mos on airline tickets all year round

• Free Global Airport lounge membership & up to 4 passes every year

• Complimentary Purchase Protection up to 180 days

• Travel Insurance coverage of up to

₱

10 million¹

• 50% off on deals at restaurants, fitness studios or wellness centers

all year round.

• Travel Insurance coverage of up to

₱

20 Million¹

• Free unlimited access to PAGSS international airport lounge in NAIA 1

and NAIA 3.

BPI eCredit

The Internet Shopping Card

• Companion card with a different card number and lower limit

designed exclusively for online purchases.

•

Free for life with any BPI Credit Card.

• Earn 1 BPI Point for every

₱

35 spend

BPI Amore Cashback

The Essentials Cashback Card

• Earn cashback⁴ for every

₱

1,000 local spend, both in-store and online: 4% on

supermarkets, 1% on drug stores & utilities, 0.3% on everything else

• Earn as much as

₱

15,000 in cashback every year

Petron-BPI Mastercard

The Practical Motorist Card

•

₱

200 Petron Fuel Voucher as welcome gift to newly approved

principal cardholders

• 3% rebate on Petron fuel purchases²

(up to

₱

15,000 fuel rebates per year)

1

•

•

Earn 1 BPI Point for every ₱35 spend

Travel Insurance coverage of up to ₱2 million

BPI Blue Mastercard

The Sensible Card

-

-

POEA-Validated

Contract of Employment

Latest two (2) months

proof of remittance*

LAND-BASED

(AGENCY-BASED WORKERS)

SEA-BASED

(AGENCY-BASED WORKERS)

DIRECT HIRE

- POEA-Validated

Contract of Employment

- Overseas Employment

Certificate

validated OFW

information sheet

- Latest two (2) months

proof of remittance**

- POEA-Validated

Contract of Employment

- Overseas Employment

Certificate

or POEA–

validated OFW

information sheet

- Latest two (2) months

proof of remittance*

FOR OVERSEAS FILIPINO WORKERS (OFW)

Must be at least 21 years old

Minimum fixed monthly income (excluding overtime, commissions

or service fees) should be at least:

QUALIFICATIONS:

₱

15,000

BPI Blue Mastercard, BPI Edge Mastercard

Petron-BPI Mastercard, and BPI Amore Cashback

₱

40,000 BPI Gold Mastercard

₱

100,000 BPI Visa Signature

₱

80,000

BPI Amore Platinum Cashback

BPI Platinum Rewards Mastercard

For the following, minimum monthly income should be at least:

Employment tenure should be at least 2 years. If less than 2 years

employed, applicants must be employed in one of the top 1,000

companies and should have a minimum fixed monthly income

of

₱

20,000

Must have business or residence contact number and active email

address

₱

15,000 Overseas Filipino Workers (OFW)

₱

30,000 Self-employed

YES, I am interested to get a BPI eCredit together with my approved credit card.

Signature: _________________________________________________________________________

My Card Selection⁵

Primary Card: _______________________________________________________________________

Secondary Card: _____________________________________________________________________

BPI Edge Mastercard

The Value for Style Card

•

Earn 1 BPI Point for every ₱50 spend

•

Affordable monthly membership fee

Relationship with Remitter Remitter’s Gender

Remitter’s Nationality Country of Origin

Filipino

Non-Filipino (please specify:) ___________________

IMPORTANT: Please provide complete information so your application can be immediately processed.

Last, First, Middle

Nature of Business/Industry

Relationship to Principal Cardholder

Email Address

Source of Funds

(Salary, Business, Commission, Remittance, Pension, etc.)

Employer/Business Name

Employer/Business Address

Home Phone Number

(if provincial include Area Code)

(ZIP CODE)

Home Address: Unit No., Floor No., Blk & Lt No., Tower Name & or Bldg. Name & or No., St. or Road no., Village Name/No., Brgy., Municipality / City, Province

Home Address: Unit No., Floor No., Blk & Lt No., Tower Name & or Bldg. Name & or No., St. or Road no., Village Name/No., Brgy., Municipality / City, Province

Citizenship

Sex Civil Status

Male Female

Single Married Separated Widowed

Place of Birth

Birthdate (mm/dd/yyyy )

6 3 9

Mobile Number

(ZIP CODE)

Office Address: Dept., Co. Name, Room No., Floor No., Blk & Lot No., Bldg. Name and/or No., St. or Road Name/No., Village Name/No., Brgy., Municipality or City, Province

Position (For Insurance Agents, provide Insurance Commission License Number) Nature of Business/IndustryYears with Present Employer / Business

Office Email Address

Previous Employer

Basic Monthly IncomePreferred Card Delivery Address

Home Address

Office/Business Address

Office / Business Phone Number / Local

Employer / Business Name

Employed Self-employed

Retired

Beneficiary of an OFW

Others ________________

OFW

Employment Type

Your credit card billing statement will be sent only to this email address. Please ensure that the given email address is correct.

E-Statement

Email Address

Birthdate (mm/dd/yyyy)

Name

Last, First, Middle

Email Address

Employer / Business Name

Mobile Number

6 3 9

About My Spouse

Name

Last, First, Middle

Mother’s Full Maiden Name (First, Last)

Educational Attainment

Grade School High School College Post Graduate

SSS Number / GSIS Number

Citizenship

Filipino Non-Filipino (please specify:)

Car Ownership

Birthdate (mm/dd/yyyy)

Place of Birth

Sex

Male Female

Name to appear on card (Nicknames or aliases are not acceptable, must not exceed 21 characters, including spaces)

(ZIP CODE)

Home Phone Number

(If provincial include Area Code)

Mobile Number

6 3 9

T.I.N.

(Tax Identification Number)

Single Married Separated Widowed

Civil Status

No. of Dependents

None

Mortgaged

Owned

If YES, specify your company and position:

Company name

Position

Number of Years in Residence

Yes No

If YES, please provide the information below:

Name of DOS

Company name

Your Relationship to DOS

Are you related to a Director, Officer or Stockholder of BPI, or any BPI Subsidiary or Affiliate?

NOTE: This applies to spouse or relation within the second degree of consanguinity or affinity (e.g. parent, child, siblings, grandparent and in-laws) or others

(e.g general parent, co-owner etc.) Please disclose all relationships and indicate sheet if necessary.

Yes No

Are you a Director, Officer or Stockholder of BPI, or any BPI Subsidiary or Affiliate?

For inquiries and comments, please send us a message through www.bpi.com.ph/contactus or call our 24-hour BPI Contact Center at (+632) 889-10000

Regulated by the Bangko Sentral ng Pilipinas.

V0323 The information contained in this application form is accurate as of publishing date 03/2023 and is subject to change after such date.

Pay at least the Minimum Amount Due ON or BEFORE payment due date. Penalties and late charges will be strictly imposed if payment is done after due date. Paying less than

the total

amount due will increase the amount of interest you pay and the time it takes to repay your balance.

IMPORTANT REMINDERS

By signing below, I (We) confirm that:

2

nd

Supplementary Cardholder

(PLEASE READ BEFORE SIGNING)

Declaration

PRINCIPAL CARDHOLDER

DATE

1

st

SUPPLEMENTARY CARDHOLDER

DATE

2

nd

SUPPLEMENTARY CARDHOLDER

DATE

SIGNATURE

Seller’s Employee No.

Reference Code

Branch Code

Agent Code

0 - Branch 5,6,7,8, - RM, 1 - CRS, 2 - Unipro

4 - RO, A - OF, B - RA, E - ABM, W - WDCS,

K - Corp. Banking, F - Bus. Banking

Doc. Image No.

UPDQ - Regular

URDE - Express Start

OTHERS: _________

BRANCH

DIRECT SALES

AGENCY CODE

AGENT CODE PROGRAM CODE

CARAVAN CODE

DSE

DSY

DSC

For BPI Use Only

For Express Start application:

Implemented DTAS Control No.: ______________________________________

Card Type

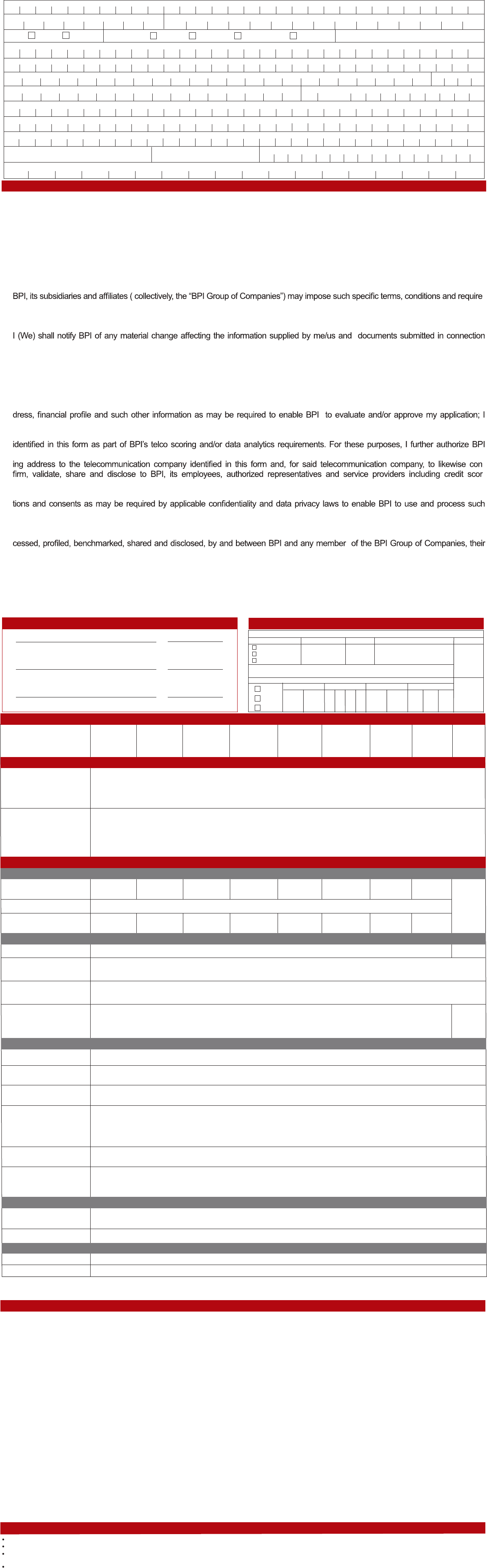

Finance Charge or

Nominal Interest Rate

1

(Effective Interest Rate

per month )

2

Cash Advance Finance

Charge or Nominal

Interest Rate

per month )

(Effective Interest Rate

3%

(2.73%)

3%

(3.16%)

e-Credit

BPI Visa

Signature

Amore

Platinum

Cashback

Amore

Cashback

Edge

Mastercard

Petron-BPI

Mastercard

Gold

Mastercard

Blue

Mastercard

25%

of the unpaid amount, exclusive of litigation and judicial costs

Membership Fees

Transaction Fees

Service Fees

Penalty Fees

FREE

In case of default, Cardholder shall pay the following in addition to penalty and charges:

25%

of the amount due

₱

1,550

per year

₱

2,250

per year

₱

1,550

per year

₱

110

per month

₱

2,050

per year

₱

5,000

per year

₱

775

per year

₱

1,125

per year per year

₱

775

₱

55

per month

₱

1,025

per year

₱

2,500

per year

Platinum

Rewards

Mastercard

₱

4,000

per year

₱

2,000

per year

₱

5,500

per year

₱

2,750

per year

Free for Life

Principal Card

2

nd

to 6

th

Supplementary Card

1

st

Supplementary Card

Cash Advance

Foreign Currency

Conversion

Gaming Transactions

Special Installment

Plan (S.I.P.)

Pre-termination

Card Replacement

Check Protect

Statement of Account

Copy

Account Maintenance

Fee

Express Start

Cancellation Fee

4

Special

Installment Plan

(S.I.P.) Loan Service Fee

Late Payment

Returned Check

Attorney’s Fee

Liquidated Damages

₱

100 for every returned check and additional

6%

of the check amount

₱

850

or equivalent to the value of the unpaid minimum amount due,

whichever is lower, per occurrence per card

₱

1,500

/month or the overpayment if less than

₱

200, will be debited from:

A) Closed credit card accounts with overpayment for more than one (1) month from

the date of termination/cancellation

B) Credit card accounts with overpayment with no activity for the past 12 months

₱

200

₱

200

per statement of account

₱

1,200

or

2%

of the funded check amount by the BPI Credit Card, whichever is higher

₱

300

per S.I.P. Loan Availment

₱

400 /card

plus

of the loan principal amount if pre-terminated before the first billing

₱

550

₱

500

₱

550

plus applicable interest of the next monthly payment

if pre-terminated after the first billing using the diminishing balance method

2%

0.85%

of the converted amount plus the

1%

assessment fee of Mastercard/Visa,

using the foreign exchange rate of Mastercard/Visa at the time the transaction is posted

or 3% of the gaming transaction, whichever is higher,

shall be charged for every gaming transaction in casinos and/or online betting

₱

200

flat fee per transaction

N/A

N/A

RATES AND FEES TABLE

Interest Rates and Charges

Card Fees

3

1

Finance Charge

2

Effective Interest Rate is the average monthly interest divided by the Average Principal Balance.

3

Cash Advance Effective Interest Rate per month = Average Monthly Interest plus Cash Advance Fee of 200 divided by the Average Principal Balance.

4

Express Start Cancellation Fee only applies to cardholders with accounts under deposit holdout if card is cancelled before the first anniversary date.

Enjoy all these features only with BPI Credit Cards

CREDIT-TO-CASH

Convert up to 100% of your available credit limit to CASH and pay in fixed monthly

installments for up to 36 months. Terms and Conditions apply.

BALANCE TRANSFER

Transfer your other credit card balances to your BPI Credit Card and pay in fixed

monthly installments for up to 36 months. Terms and Conditions apply.

S.I.P. FOR SCHOOL

Reimburse tuition fees and other school-related expenses charge to your BPI

Credit Card and pay in fixed monthly installments for up to 24 months. Terms

and Conditions apply.

VIEWING OF YOUR CARD DETAILS ONLINE

You may view your statement of account up to 11 months, available balance, last

payment details, latest transactions, and other details via BPI Online. Enroll now at

www.bpi.com.ph.

PAY YOUR CREDIT CARD EASILY THROUGH ONLINE BANKING

Enjoy fast, easy, and secure bills payment through BPI's electronic channels - BPI

Online and the BPI Mobile App.

24/7 CUSTOMER SERVICE HOTLINE

For full service account inquiries or lost card reporting, comments and other

concerns, you may contact our 24-hour BPI Contact Center at 889-10000

(all areas with “02” area code) 1-800-188-89100 (domestic toll free for PLDT) and

+632 889-10000 (mobile phone and international calls); and International

Toll Free Numbers (refer to www.bpi.com.ph Contact Us link for details) or

send us a message through https://www.bpi.com.ph/contactus.

BPI REWARDS

ENJOY REWARDS POINTS OR CASHBACK

BPI EXCLUSIVE OFFERS AT PARTNER MERCHANT

SAVE AS MUCH AS ONE MONTH’S FINANCE CHARGES

New purchases are not subject to finance charges even if you only partially pay the

Use your BPI Blue, Gold, eCredit, Edge, Platinum Rewards Mastercard and Visa

Signature to earn BPI Points. With our wide selection of rewards, you can redeem

your accumulated non-expiring points for shopping credits, shopping eGCs, dining

eGCs, miles, and more. You may also enjoy cashback when you pay for your needs,

shop, or dine using your BPI Amore Cashback or Amore Platinum Cashback card.

The choice is yours!

Get more out of your credit card spend whenever you use your BPI Credit Card

whether in-store or online. Enjoy discounts, exclusive perks and deals that give

you value for money.

1.85% LOW FOREX CONVERSION

Save while you shop abroad. Enjoy one of the lowest forex conversion

rates of just 1.85%.

outstanding balance of the previous month.

CASH ADVANCE

Withdraw up to 100% of your available credit limit for your cash needs anytime, from

any Mastercard or Visa affiliated ATMs worldwide. Terms and Conditions apply.

SUPERIOR CHIP TECHNOLOGY

BPI gives you the country’s

first EMV-compliant (Europay-Mastercard-Visa) Smart

Chip card. EMV technology helps mitigate information fraud for a more secure

transaction environment particularly when you use it in 42 EMV-compliant

countries in Europe, Middle-East and Asia Pacific.

FREE 1ST SUPPLEMENTARY CARD

Share these exciting benefits with your loved ones and the first supplementary

card is on us! Yes, we are waiving the annual membership fees of your first

supplementary card for life!

SPECIAL INSTALLMENT PLAN (S.I.P.)

Manage your budget and pay in 3, 6, 9, 12, 18, 24 or 36-months installment terms

at Real 0% or low, fixed add-on rates. Use S.I.P. in major establishments

nationwide to pay for high-ticket terms such as appliances, gadgets, furniture and

luxury shopping. Save even more when you avail of Real 0% deals.

1

Office/Business Phone Number/Local

Last, First, Middle

Nature of Business/Industry

Relationship to Principal Cardholder

Email Address

Source of Funds

(Salary, Business, Commission, Remittance, Pension, etc.)

Employer/Business Name

Employer/Business Address

Home Phone Number

(if provincial include Area Code)

(ZIP CODE)

Home Address: Unit No., Floor No., Blk & Lt No., Tower Name & or Bldg. Name & or No., St. or Road no., Village Name/No., Brgy., Municipality / City, Province

Citizenship

Sex Civil Status

Male Female

Single Married Separated Widowed

Place of Birth

Birthdate (mm/dd/yyyy )

6 3 9

Mobile Number

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

All the statements, information and supporting documents provided by me (us) are true, correct and accurate.

Any material misrepresentation or falsity or omission herein which is misleading shall be construed as an act to defraud Bank of

the Philippine Islands (“BPI”) and may be a ground of denial of my (our) application or, if already granted, the cancellation

of termination thereof, including rendering any loans granted to me (us) immediately due and payable, without prejudice to such civil

and/or criminal liability action that may pursue against me (us).

It is the sole prerogative of BPI to grant or deny my (our) application and should my (our) application be denied, BPI may provide the

reason for such decision in accordance with the requirements of applicable law.

All inf

ormation and documents obtained, collected and processed by BPI in connection with my (our) application shall remain the property

of BPI.

-

ments as they may seem necessary or appropriate in connection with my (our) availment of their products, services, facilities and channels.

My/Our application, enrollment, availment, access, maintenance and continued use of any of the products, services, facilities and channels

of any member of BPI Group of Companies shall constitute my/our acceptance and agreement to the applicable terms and conditions.

with this application.

I (We) shall agree to receive updates, notices and announcements on my (our) application and/or any of BPI’s products, services,

facilities and channels via SMS/text, email or fax transmission or such other means of communication deemed appropriate by BPI.

Where applicable, BPI may enroll my (our) approved application with any credit protection provider, or guarantee

program of any institution, whether public or private, at BPI’s sole option.

I agree and authorize BPI, whether directly or through its program partners to collect, obtain, validate and process my person-

al data such as, but not limited to, my name, birthdate, mobile number, mobile phone usage data, email address, mailing ad-

likewise agree and authorize BPI, whether directly or through its authorized representatives and service providers including cred-

it scoring institutions, to collect and share my information to any of the telecommunications companies namely; Globe or Smart, as

to inquire, validate share and disclose my information such as, but not limited to, my mobile number, email address, and mail-

-

-

ing institutions, any or all of my information including my telco score to enable the BPI to process and/or approve my application.

Prior to submitting to BPI information about individuals (including their personal data), I (we) have obtained all necessary authoriza-

information. I (we) further agree that all my (our) personal information (including those of individuals related to me (us), my (our)

transactions, business and credit relationships, accounts or account information or records which are with you, made available

to you or which are in your possession or updated from time to time, may be collected, obtained, used, stored, consolidated, pro-

successors and assigns, and their respective authorized representatives, agents and service providers, for any or all the purpose

described in the Data Privacy Statement published at https://online.bpi.com.ph and deemed incorporated by reference to this form.

I (We) have read and understood and agree to be bound by BPI’s “ Terms and Conditions of the Deposits, Products, Ser-

vices, Facilities and Channels “, as well as BPI’s “Terms and Conditions Governing the Issuance and Use of BPI Credit Cards” as

these terms and conditions may be amended or supplemented from time to time, copies of which were either provided to me (us)

or made available / accessible to me (us) via www.bpi.com.ph or such other channels or electronic applications selected

by BPI

The foregoing shall apply to all products, services, facilities and channels of BPI that I (we) may now or heareafter apply for or avail of.